Don't Break the Bank: A Student's Guide to Managing Money (23 page)

Read Don't Break the Bank: A Student's Guide to Managing Money Online

Authors: Peterson's

Tags: #Azizex666

Nelnet, Inc.

Nelnet is one of the leading education planning and finance companies in the United States and is focused on providing quality college planning and financing products and services to students and schools nationwide. Nelnet offers a broad range of financial services and technology-based products, including student loan origination, loan consolidation guarantee servicing, and software solutions. Visit the Web site at www.nelnet.com

FinAid

FinAid is a comprehensive source of information and advice related to financial aid. The site also has links to a bunch of scholarship search sites. Visit the FinAid site at http://www.finaid.org/

Quick Tips from Nelnet:

You can save on interest and repay your loans sooner by making early payments or adding a little on to your regular payment whenever you’re able.

If you choose a plan and it doesn’t work, you can switch your plan up to once a year by contacting your lender or servicer.

Whenever you move, you should be sure to call your lender or servicer so that they have your new mailing address and contact numbers.

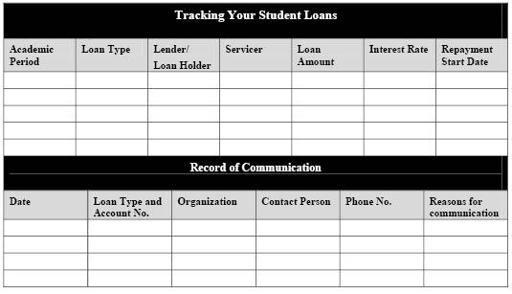

It’s important to keep track of your loans—everything from the loan amount to the repayment start date. Using a chart like the following one may be just what you need to stay organized and on top of all of this important financial matter. Feeling creative? Make your own student loan chart—one that you’ll be inclined to fill in and track!

Common Questions About Student Loan Repayment

What are my options?

The best way to repay will depend mostly on your individual circumstances. The choices include:

•

Standard:

You pay monthly installments of at least $50 over a ten-year period, with payments based on the amount you borrowed. This option is the most common and generally the most economical.

•

Extended:

If you have more than $30,000 in Stafford loans borrowed after October 7, 1998, you may be eligible to extend the term of your payments for up to twenty-five years. Remember, though, that a longer term adds interest to your overall balance.

•

Graduated:

If your loan balance is high or your income low, you may choose this plan because it offers lower payments to start, gradually increasing over time, with up to ten years to repay. However, the amount of interest you pay overall is higher than with standard repayment.

•

Income-sensitive:

Payments are determined by comparing your debt to your monthly income, are adjusted annually, and can only be used for five years. Then payments revert to the standard plan.

•

Income-based Repayment:

Available to borrowers who display partial financial hardship. Payments are based on your adjusted gross income, family size and balance on eligible loans.

What happens if I pay late or default on my loan?

Think of paying back your student loans as your end of the deal—you’re obligated to repay the debt just like any other. Paying on time offers huge rewards for your financial future, but late payments and defaulting on your debt have serious consequences, such as:

• A poor credit rating that will keep you from getting a car or home loan

• Losing the option to make monthly payments and end up owing your entire balance at once

• Piling up late charges and collection fees

• Garnished wages

What programs are out there to help get me back on track?

•

Deferment:

If your lender approves it, you may be able to temporarily stop making payments for reasons such as economic hardship, unemployment, or returning to school full-time. With deferment, interest on subsidized Stafford and Perkins loans is paid. For unsubsidized loans, though, you’ll still be responsible for paying the interest.

•

Forbearance:

As with deferments, getting a forbearance means your payments are temporarily postponed. Your lender must approve the forbearance. During forbearance, you’ll still be responsible for paying the interest that builds on your loans.

•

Consolidation:

If you have multiple loans through multiple lenders, you may find it more efficient and less expensive over the long term to consolidate all of your loans into one larger loan. You’ll need to carefully weigh the circumstances, though, calculating things like whether your monthly payments are substantially lowered, how much (if any) additional interest you’ll pay, and more.

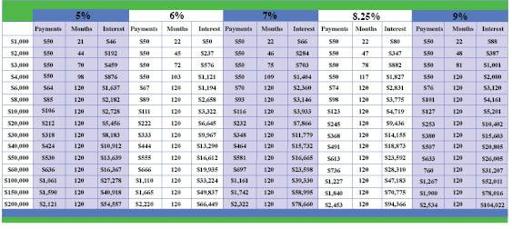

This sample chart shows different repayment plans with monthly payments.

[Source:

http://www.dollarsensei.com/TSAC/PDF/RepaymentSchedule.pdf

]

Chapter 12

Managing Your Finances While in College

College is sort of like a training ground for the real world. You have to start acting like an adult and getting used to doing “grown-up” things like paying your own bills, but you probably aren’t totally on your own yet, so you still have some sort of safety net.

Practice Being Independent

If you’re like a lot of college students, your parents may still be helping you out financially while you’re in school. Even if they no longer pay your bills or give you an allowance, they may be helping in ways that aren’t as obvious. For example, you may still be covered under their insurance policy, which makes your costs much cheaper than if you had to get coverage on your own.

It’s easy to become a little lax when it comes to money and staying on top of your

finances because you know your parents will be there to help you out if you get stuck. And while it’s nice to have that safety net, this can also serve as a sort of crutch that prevents you from becoming totally independent and taking your own financial responsibility seriously.

By the time you’re in college, you should check your credit report, if you haven’t done so already. Even if you’ve never had a loan, you probably still have something on your credit report. Don’t think so? You might be surprised. A study conducted by Sallie Mae found that only 2 percent of undergraduates had no credit history.

So you may need to pretend your parents don’t exist (financially speaking) for a month or so, just to see how well you do. (This will also help spotlight areas where you might need to brush up your skills or get more information.) Obviously, you can always ask your parents for help if you have an emergency or really run into trouble, but it’s good to get into the habit of handling things on your own as much as possible. Think of it as a practice run at being a self-sufficient adult. You probably are capable of doing more than you think, and it can be a big confidence boost to know you don’t need your parents to do everything for you anymore.

No Such Thing as Normal

Fun Fact

A study of student spending by Yale students in 1915 found that one freshman spent $4,500 in his first year. That’s the equivalent of more than $94,000 today!

There really is no such thing as a “typical” college student these days. Many adults are going back to school to complete their degree or earn another one in order to help their career. Some people in their 20s may have had a delay in their path to college because they had to get a job or were serving in the military. A lot of students are opting to stay at home and commute to school in order to save money. And an increasing number of students are taking some or all of their classes online from home.

Your budget and financial issues will vary from those of your fellow students, depending on your individual circumstances. So don’t waste too much energy comparing yourself to them. Yes, it’s easy to get bummed out if one of your classmates seems to have an endless supply of spending money. But it’s very possible that she took out a lot of student loans (which she is now spending recklessly) and will soon find herself with mega debt.

For the Dorm Dwellers

If you live on campus, you may only have limited financial issues to deal with (as far as living expenses go—tuition and school expenses are a whole separate issue). Your basic living expenses are probably all bundled into your housing costs, and you are likely required to have a meal plan, which will take care of some of your food expenses.

But depending on what type of meal plan you have (and what you eat), you will probably need some extra money for snacks and additional meals off campus. And you will also have to pay for your cell phone and any other bills you have. If you have a roommate, the two of you may also decide to jointly buy some things for the room.

There is also the cost of transportation. You may need to pay for transportation to get around campus or to travel off campus for errands or to get to work. And of course you will need to pay for trips back home. The average college student living on campus spent $1,073 on transportation in 2010–11.

According to one survey, college students receive an average of $312 per month from home and have $453 in monthly earnings.

There are lots of other “little” expenses that can quickly add up. Think about your laundry, for example. You will probably be surprised at how much change those washers and dryers can eat up!

So even if you don’t have an apartment, a car, or other major expenses, you will still be spending some money every month while at school, so you need to have a plan for how you will pay for that.

Off-Campus Living

If you will live off campus, you may be looking forward to having some “freedom” without your RA or other college authorities being able to tell you what to do. On the flip side, though, you will have additional expenses and other issues to consider, things you wouldn’t need to worry about if you lived on campus.

First, you will need to find an apartment. Your school’s housing office may be able to connect you with some leads or suggest resources for finding off-campus rentals.

Tip:

Rents are often highest for apartments closest to campus, because landlords figure you’ll pay more for this convenience. If you are willing to live further away from campus and walk or take the bus to school, you may be able to find more affordable rents.

Before you start looking, you must examine your budget and figure out what you can afford per month. Look around to see what’s available and see how the average rents compare to your monthly figure. Be sure to factor in the cost of utilities, if they aren’t included in the rent. If the rents are too high for you on your own, calculate the cost if you split it with another person (or several). Keep in mind that you may have to pay a security deposit upfront—usually one month’s rent, but occasionally even more than that.