Entrepreneur Myths (14 page)

From home office to office to billion in sales.

Rob Snyder, a successful entrepreneur and business attorney, launched a startup five years ago out of his home office. He had the capital to start immediately out of an office. Instead, he hired Pierre Koshakji, a friend of mine, to help him manage the process of setting up the entire startup infrastructure. Rob funded a good portion of the company’s early phase on his own dime, and kept costs low by waiting months to scale to an actual office. He was smart. Six years later, Stream Energy leases offices at the beautiful Infomart in Dallas and has more than 200 employees. More importantly, they’ve reached revenues of close to $1 billion.

From home office to office to billion in sales. That’s doing it right. However, I do recall Pierre sometimes using Starbucks as an office during the startup phase, before they went from home office to office.

My suggestion on the evolution of your office space is simple: home office

to

Starbucks

to

office.

Do you still want to burn money on an office without any revenues? I assure you, if you’re funding your startup on your own dime before you have revenues or a completed product, and you’ve signed an office lease for two years — you’re foolish, just like I was in my younger days. I burned my own money, got into an office, the company fucking failed, and then I had to deal with the two-year lease exit issues. I won’t do that again.

My advice: Don’t get into an office on any venture until the company has revenues or has been well-funded. Remember, both Hewlett-Packard and Apple started out of garages. Don’t be embarrassed to be a garage entrepreneur, or better yet, a “Starbucks

preneur

.” Plus, the espresso is better.

Brain Candy: questions to consider and ponder

(Q1)

When should you rent an office?

(Q2)

Do you need an office to raise capital?

(Q3)

Do you need an office if you have employees?

(Q4)

What kind of office should you get? Is location critical? The neighborhood restaurants?

(Q5)

What should your office look like? Are you going to decorate it according to the type of culture you want to build?

(Q6)

Have you ever used Starbucks as your office?

Entrepreneur

Myth 22

| You don’t need an attorney

Do you want a shark on your side? It’s natural for entrepreneurs to seek a shark for their legal representation. But in the land of the legal, I don’t prefer sharks because then you have a clusterfuck scenario of sharks battling it out with sharks. Good business attorneys aren’t sharks, they’re owls. They are wise, patient and shrewd. They understand better than anyone how to work with the damn sharks.

Good owl business attorneys are worth every fucking dollar. They’ll save you money by negotiating better contracts, helping you avoid potential legal headaches, sharing business contacts and much more. Include them early in the startup process.

Choosing the right attorney is critical. Ask friends and business associates to recommend an attorney — just like you do when looking for a new doctor, dentist, hairstylist or plumber. Attorneys are like plumbers. You don’t think you need one in a startup until the shit hits the fan. A good attorney is going to cost you; don’t be cheap.

You absolutely

should have an attorney review any operating agreements between you and the rest of your partners. Don’t be a fool. If one of your partners uses their attorney for the task, get your own attorney to review it separately to protect your interests. It’s nothing against your partner’s attorney, but it’s essential you have your own legal representation. This will help you avoid potential lawsuits or getting fucked down the road.

You can incorporate your company yourself, if it’s a limited liability corporation (LLC). You don’t need an attorney for that — I don’t give a fuck what anyone tells you. However, the right attorney can make a difference when you’re raising venture capital, because if they’re already working with VC firms, they may be able to open doors for you.

If you go the raising capital route, whether from angels, venture capitalists or institutional investors, I highly recommend you use an attorney. Don’t attempt it without one. Unless you know what you’re doing, raising capital can get hairy, because there are state or federal laws associated with raising money. The laws vary by state or country, but they are set up to protect investors from scammers, cheats and liars.

You need to know the legalities of raising capital or you risk having the SEC knock on your door, asking a lot of questions. Now that can be expensive. When I started Futuredex, the SEC knocked on our door because they thought the company was brokering deals. We had to hire an SEC attorney to prove otherwise. Futuredex was an online media and matching service so it was easy to prove that — after spending $30,000 on attorney’s fees. If you solicit money from people you don’t know, be especially careful and consult an attorney. If you’re getting referrals from friends, family and business associates, the laws are less strict, but you should still check with an attorney — your attorney.

I’m not going to give you legal advice (I’m not an attorney, nor do I ever want to be one), but I highly recommend getting an attorney when you reach the venture capital funding stage of your business. It’s a complicated process, plus VCs like it when a law firm that deals with VCs represents you.

If you will be approaching various types of investors, you need an attorney to help you develop a PPM (private placement memorandum), just to cover your ass. PPMs don’t come cheap — they can cost $20K and higher. From my perspective, PPMs are business plans with all the legal documentation and a thousand disclaimers to cover your ass. PPMs disclose all risks involved with the investment. They’re similar to those forms doctors make you sign just as you’re rolling into surgery. With all the legal crap, I can’t figure out why anyone would voluntarily invest into any venture after reading one. But if you’re seeking money from unknown investors, you must have a PPM.

Choose a business attorney who has provided legal advice to entrepreneurs in various stages of the cycle. Conduct due diligence on attorneys just as you would on investors. Get some referrals and talk to a few of their current clients.

My advice: Based on my experience, attorneys who are principals are, on the average, much better to deal with than attorneys within large law firms. If your attorney has a smaller firm, you won’t get lost in the shuffle or passed down to an associate. Some investors are impressed if you’re represented by a law firm that’s in the top 10 in the country. I have gone the big law firm route in some venture capital transactions and, to put it bluntly, I was not that impressed. In other situations, I have used large, prestigious law firms like Wilson and Sonsini, and Latham and Watkins — and they were kick ass.

Owl attorneys have high moral fiber. I hired an attorney for some transactions who was great but we differed on moral fiber. This asshole slipped additional verbiage into contracts without telling me — to protect me, but to the detriment of the entrepreneur. I got rid of this attorney after I got a call from one of the entrepreneurs indicating the changes

my

attorney made without my knowledge or approval. Not every attorney is fair-minded and just because they are trying to protect your ass does not mean they should act like a shark.

Take the time to choose the right attorney no matter what size of law firm

The process can be tedious but I can help with a few recommendations. Attorney Rick Citron of Citron & Deutsch in Los Angeles is an owl. He’s been there as an entrepreneur more than once, so he knows the art of the startup game. Fred Greguras, in Silicon Valley, is another owl attorney. He is absolutely kick-ass too.

I’ve also worked with and highly recommend these two wise-owl attorneys: Tailim Song in Dallas and Hyatt Fried in Miami. I also recommend entertainment attorney M. Kenneth Suddleston in Los Angeles, and Jim Chapman in Silicon Valley.

My advice: When (not

if

) you decide to get an attorney, find one with a background in your sector that has experience in various stages of the startup life cycle.

If your venture is high tech, find an attorney who represents high-tech companies like Rick Citron, Fred Greguras or Jim Chapman. If you’re producing a film, it’s wise to have an entertainment attorney, like Hyatt Fried, or one in Los Angeles or New York like Kenneth Suddleston, who has a ton of great entertainment contacts — especially when it comes to getting access to studios or distribution.

A great attorney can make a

substantial

difference in your venture. A bad attorney becomes a cost item in your expense column. Choose one wisely.

Owl Attorney Contact information:

Rick Citron

| Citron & Deutsch | candlaw.com

Fred Greguras

| K&L Gates LLP | klgates.com

James C. Chapman

| Foley & Lardner LLP | foley.com

M. Kenneth Suddleston

| Wildman Harrold | wildman.com

Tailim Song

| Tailim Song Law Firm | tailimsong.com

Hyatt Fried

| Westin, Florida

Brain Candy: questions to consider and ponder

(Q1)

What is your experience in dealing with attorneys? Do you like attorneys, or do you see them as a necessary evil?

(Q2)

Has your attorney opened doors for you with investors? If not, then why not? Have you asked them?

(Q3)

If you don’t have an attorney and are looking for one, have you checked to see if they have contacts with investors?

(Q4)

Are they knowledgeable about your sector?

(Q5)

What is their current client list that could be of help to you in terms of business alliances, customers, suppliers, investors, etc.?

(Q6)

Have you ever fired an attorney?

Entrepreneur

Myth 23

| In business, most people tell the truth

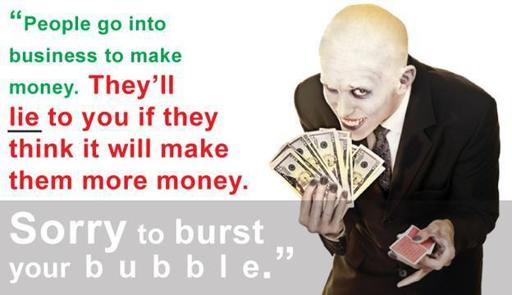

I know entrepreneurs in their 60s who still believe in this fairytale. They should know better. People go into business to make money. They’ll lie to you if they think it will make them more money. Sorry to burst your bubble.

The level and extent of how much an entrepreneur trusts others in business depends on their business experience and intuition, more than education or age.

Other books

Harley Jean Davidson 03 - Evil Elvis by Virginia Brown

Webb's Posse by Ralph Cotton

Realm of the Dead by Donovan Neal

One Day It Will Happen by Vanessa Mars

Captain's Choice: A Romance by Darcey, Sierra

Blake's Pursuit by Tina Folsom

Best Bondage Erotica 2 by Alison Tyler

First Contact (Galactic Axia Adventure) by Laughter, Jim

Then We Die by James Craig