The Great Depression (16 page)

Read The Great Depression Online

Authors: Benjamin Roth,James Ledbetter,Daniel B. Roth

The month just closed has been the poorest in my entire law practice. Everybody is waiting for the November election. Betting of 2 1/2 to 1 favors the Democrats but Hoover is getting stronger every day and I think he has a chance to win. The main issues are “tariff” and “sound currency.” Just now the United States has become a dumping ground for cheap European merchandise which is made possible by depreciated European currency. I made my first political speech on this subject a few days ago.

The stock market is at a standstill. Commodities are again going down. Wheat is selling at 44 1/8¢ per bushel. This is an all time low record for U.S. and is a record low for almost 300 years in Europe.

U.S. Steel lost 27 million in last 3 months. Sheet & Tube still loses at a rate of more than a million per month.

The political campaign is over and tomorrow is election day. It has been a bitter campaign and will be long remembered. The “forgotten” man who is out of a job will probably decide the election. On Wall St. the betting is 6 to 1 in favor of Franklin D. Roosevelt, the Democratic candidate. In spite of this I still hold some hope for Hoover. I delivered seven political speeches for Hoover—mostly on the tariff question and other national issues—and I thoroughly enjoyed the experience. Because of the depression and the national election I have developed a keen interest in economic and governmental questions. This is also true of a great many people.

The election is over and Franklin D. Roosevelt, the Democratic candidate, becomes President in one of the greatest landslides in all history. He captured the electoral votes in 42 states and his opponent Hoover got only 6. In 1928 Hoover got the electoral vote of 40 states. By a plurality of over 15 million votes the people decided they wanted the “new deal” promised by Roosevelt. It is interesting to note that Mahoning County elected all of its Republican candidates in spite of this national landslide. I will follow with interest the question of “lower tariff” promised by the Democratic Party. I don’t see how it can be done in the face of depreciated European currencies.

It seems that earlier newspaper reports of election results were exaggerated. The Democratic candidate for President (Roosevelt) won by a popular plurality of about six million instead of fifteen million as first reported.

CHAPTER 3

NOVEMBER 19, 1932-APRIL 22, 1933

“Business is at an absolute standstill.”

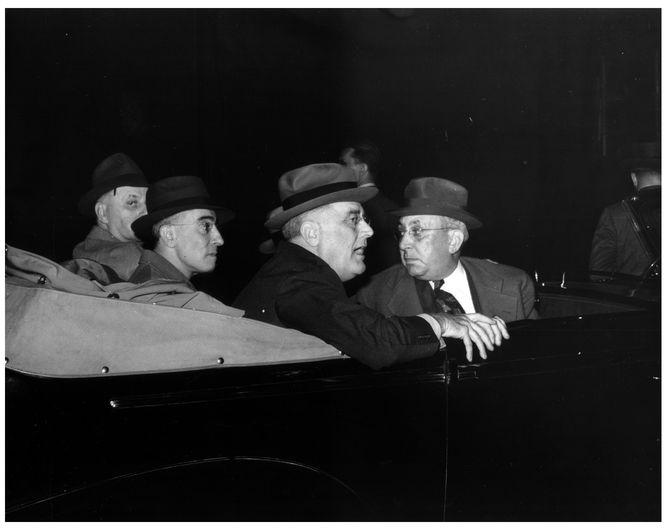

President Franklin Roosevelt made a number of visits to Youngstown. Here, he is accompanied by Frank Purnell (far left), president of Youngstown Sheet & Tube, and two unidentifiedmen. (The Mahoning Valley Historical Society)

EDITOR’S NOTEBy the end of 1932 one out of every four families in Youngstown needed the support of charity. In January 1933 Benjamin Roth wrote in his diary that people seemed to be “marking time” until the new Democratic president took office. But in the short time between Franklin D. Roosevelt’s November landslide victory as the thirty-second president of the United States and his inauguration on March 4, 1933, the economic crisis actually deepened. Throughout the nation events taking place in the banking system, farming, the Hoover administration, and overseas created a more turbulent social and economic environment. As Richard H. Pells puts it, “Economically, the winter of 1932-1933 was the worst in American History.”In 1933 more than 40 percent of home mortgages were in default. Foreclosures, notes Roth, “are no longer a disgrace.” In the nonexistent real estate market of the Great Depression, banks often deferred foreclosure proceedings. Banks realized there would be no recoup on a seized property that they couldn’t sell, rent, or even afford to maintain adequately.Farmers were the most vulnerable to foreclosure in the Depression. “In Iowa, the most heavily mortgaged state, nearly one-third of the value of farms was in thrall, mainly to banks and insurance,” describes Arthur M. Schlesinger Jr. With bread selling for three cents a loaf and milk at eight cents a quart, farmers organized an influential movement called the Farmers’ Holiday Association to protest, sometimes violently, price devaluation. In May 1932 hundreds of farmers disrupted the nation’s food supply by destroying their crops and blockading highways and rails to prevent trucks or trains from distributing their milk or chickens. They overpowered and disarmed local sheriffs who tried to bring order. Though Americans were starving throughout the country because they didn’t have the means to eat anymore, farmers poured milk onto the side of the road. “Seems to me there was a Tea-party in Boston that was illegal too,” rationalized one farmer, according to historian T. H. Watkins.Militant farmers also intimidated, even injured, sheriffs, bank officials, or lawyers who attempted to foreclose farms or seize properties due to unpaid taxes. By 1932 the typical farmer’s income had fallen by 64 percent, yet his indebtedness had only been adjusted to drop 7 percent. As Schlesinger explains, “A cotton farmer who borrowed $800 when cotton was 16 cents a pound borrowed the equivalent of 5,000 pounds of cotton; now with cotton toward 5 cents, he must pay back the debt with over 15,000 pounds of cotton.” Considering no one had the purchasing power in 1932 to buy 15,000 pounds of cotton from each and every cotton farmer who needed to pay back loans, farmers took the notion of loan forgiveness into their own callused hands. Mobs of angry farmers gathered at bankruptcy proceedings and farm auctions, carrying clubs and swinging a noose around a nearby tree to deter outside bidding. One Iowa debtor was able to pay back the $800 mortgage on his property for just $1.90. Sometimes, the practices turned to violence. A New York Life Insurance officer was attacked by a mob when he offered a price for a farm that was less than the value of the mortgage. In January and February 1933 farmers sabotaged at least seventy-six auctions. The outcry worked. The Iowa state legislature passed a moratorium on foreclosures on February 17, 1933. Minnesota and other farm states soon passed similar laws that winter.

It seems unbelievable but conditions seem to be even worse. The month of October was the worst ever experienced in my law practice but November is on the way to beat even that low record. So far this month I have taken in $19 in cash. I believe that is better than most lawyers have done.

Congress will convene in 2 weeks and a great many serious problems are coming up for consideration. One of them is a possible cancellation of the war debts of foreign countries. In the meanwhile the steel industry operates at 15%—bank failures start again with 4 last week closing in Pittsburgh and 5 in Oklahoma. The newspapers are suppressing reports of these failures in order not to alarm the people.

Nothing new to report. Several hundred “hunger” marchers passed thru Youngstown on their way to Washington where they will demand “food instead of bullets” from Congress when it convenes on Monday. I passed about 200 of them on West Rayen Ave. and they were singing “Battle Hymn of the Republic” as they marched.

Everybody on the street is talking about Europe’s request that U.S. cancel the war debts. In the meanwhile the pound sterling goes to a new low of $3.12. Also wheat, oats, and corn reach new low levels. At Chicago wheat sells at 42¢ bu; oats at 19¢ and corn at 14¢. After a farmer in Montana pays transportation to Chicago he gets a net of about 12¢ a bushel for his wheat. As a result they are burning corn for coal and using wheat and oats for cattle. It is hard to explain this situation while so many people go hungry. There is also considerable discussion about the new science of “technography” which holds that new machinery and electricity have replaced many men in industry who will never find a job again. I am confident that new inventions and scientific discoveries will remedy this situation.

A salesman just tried to sell me a small pass-book on the Dollar Bank at 72¢ on the dollar. He states the tenants of the Dollar Bank are using this means to pay their office rent, notes, mortgages, etc. Books on Home Savings and on City Bank are selling at 62¢ on dollar. It is a fine opportunity to pay off notes and other obligations at a discount.

Congress is now in session and promptly ejected the “hunger marchers.” Also it refused to cancel the foreign war debts but agreed to reconsider them later.

Five lawyers are up for disbarment in Warren on a charge of misappropriating money belonging to clients. It seems that all misdeeds and grievances are coming to the surface during this time of depression.

In the meanwhile business is at an absolute standstill. Merchants are fighting hard for Christmas business but report there is none in sight. Last night’s paper states that in Youngstown one out of every four families is being supported by charity.

The year draws to a close with business stagnant and no sign of improvement. Money is non-existent and “scrip” is being used in increasing proportion all over the country. Wheat and other commodities are reaching new lows and the stock market is again on the way down.

Both 1931 and 1932 will take their place as the poorest years of my law practice. In both years my earnings fell below the very first year of my practice.

It is becoming increasingly evident that we will not see normal business for another year or two.

Predictions are freely made that a great many railroads will go into receivership in the coming year. Traffic on railroads is steadily declining and interest charges on bonds have not been earned for some time. During the past two years defaults have been prevented by loans from the government. Many junior railroad bonds are now selling to yield 20% to 70%—if the interest is paid. B&O bonds sell at 10 and yield 4 1/2%. The claim is made by railroads that they were unable to build up a surplus during good times because of severe government regulations and now they are up against it.

Again and again it is being proven that the only man who can survive this storm is the fellow who put his earnings into government bonds before the crash came or second to that—built up a large life insurance reserve on which he could borrow. So far life insurance has come thru with flying colors.

I interviewed five clients this morning and in not a single instance was a fee even remotely possible. Following are samples of why law practice is unprofitable today:

1. Mrs. A’s boy received a broken leg and other injuries while coasting on a street by collision with an automobile. The facts present a fair case of liability. Investigation shows that the driver of the automobile carries no insurance; has no property except the automobile which is mortgaged for more than its real value; is out of a job and has 3 children to support and will soon have to look to the city for support. To file suit would be a waste of time and money. In normal times this man would have been collectible, would have carried liability insurance and the case might have been worth $500. Today almost all personal injury cases are worthless because no insurance is carried and defendants are judgment proof.

2. Mr. A, a merchant, came in with a 2nd mortgage of $1,200 on a property he wants foreclosed. Investigation shows that taxes, first mortgage, and delinquent interest will consume the property and leave nothing for the second mortgage. The mortgagors are personally judgment proof. Client therefore decides not to foreclose and a fee is lost.

Instances of this kind can be multiplied. Litigation of all kind is at a standstill because people are judgment proof or because their assets cannot be liquidated. Constructive legal work such as drawing leases, incorporating companies etc. is entirely lacking. Even divorce work and criminal cases are lacking because of want of funds.

Other books

The Reaper's Song by Lauraine Snelling

Tormenta de sangre by Mike Lee Dan Abnett

The Girl in the Red Coat by Kate Hamer

When Fate Dictates by Elizabeth Marshall

Songs of Blue and Gold by Deborah Lawrenson

Scarlet Imperial by Dorothy B. Hughes

Past Imperfect by John Matthews

Girl's by Darla Phelps

The Secret Warning by Franklin W. Dixon

The Telling by Beverly Lewis