Entrepreneur Myths (41 page)

Power law works at mysterious and miraculous levels in the venture capital industry

As a venture capitalist, I learned to respect power law. The likelihood of searching, finding, investing in or creating another large hit, or billion-dollar business like Google, Groupon, Facebook or Zynga, is working against investors — and entrepreneurs.

As an entrepreneur, if you have an idea you believe will be a billion dollar hit, the power law is against you — but keep on dreaming. If you’re an astute investor like Peter Thiel, former CEO of PayPal and early investor in Facebook, the likelihood of funding another Facebook-type startup monster is against you. But keep on dreaming.

It took director James Cameron 12 years, since

Titanic

, to create another super-mega hit of power-law proportions with the film

Avatar

. As brilliant as Marc Andreesen is as founder of Netscape, and cofounder of Ning, it wasn’t Andreesen who founded Facebook or Twitter. He was smart enough to buy his way into Facebook. Now, he sits on their board.

It’s hard being an investor when the power law works against you, and when the expectations of entrepreneurs are bubble-ish. The current market is not like Prince’s song “Party like it’s 1999,” but at this point, the mathematics behind some of the valuations are working even harder against the principles of the power law. The large money that’s currently being invested by some venture capital firms (cheetahs) is enough to give any power law respecting investor vertigo. It seems the ROI expectations by investors have been either lowered or it could be that bubble-like patterns are making sixth-grade math fuzzy. It is difficult to create a large ROI when a startup valuation goes into the stratosphere.

For instance, if I invest $10 million into a company valued at $100 million post, this company will need to grow to be worth $1 billion for me to get my 10X return — assuming no further dilution. If I invest $10 million into a startup with a $1 billion valuation, that company has to grow to be worth $10 billion for me to get the 10X ROI. I use 10X ROI because, based on my experiences, most investors are looking for 10X, 20X or even 30X, when investing in early stages. I know I am. And sooner or later, someone has to lose to the principles of the power law. Only so many companies can become huge hits the size of Google, Groupon, Facebook, Zynga, or Twitter. There is no way the market can support billion dollar valuations forever, unless the sales numbers of the companies warrant that valuation. You can only have so many Apples.

From an entrepreneur perspective, you want to take full advantage of some of these bubble-ish valuations. But it can come back to haunt you if conditions change and you have to face a down-round — where the company’s valuation is reduced due to various circumstances such as lower revenues, outside market conditions, management turmoil, etc. and the subsequent round is lower causing dilution for all parties involved and to the potential benefit of the new investors. I had entrepreneurs come to me during the down-round. It’s not a fun process for anyone. From an investor perspective, it is not fun to cram down or dilute the previous investors because they invested at higher, bubble-ish valuations.

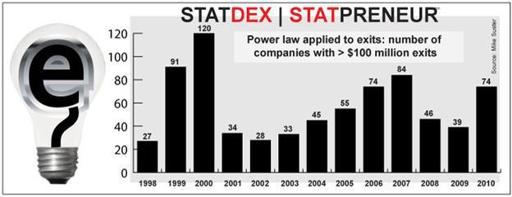

The graph below clearly illustrates the power law applied to investing. It shows how few companies over the past 13 years have achieved exits of over $100 million. This graph, by Mark Suster, one of my favorite venture capitalists, was included in an article by venture capitalist Fred Wilson entitled, “Why It's Hard Being an Early Stage Investor Right Now.”

11

(Source: Mike Suster, Partner, GRP Partners. Design and graphics by Chiko Statchimp.)

Over a 13-year spread since the first Internet Bubble of 1998 until 2010, only 750 companies have had exits greater than $100 million.

Read this number again and let it sink in.

This is a very small number when you consider that the venture capital industry funds around 1,000 early-stage companies per year, according to the National Venture Capital Association (NVCA). In reality, 5% to 10% create big exits for cheetahs and we’re not even talking about any of the angel-funded companies that made the seed stages but didn’t make it all the way through to a big exit.

Some years back, I funded a company in the hardware sector and they had to deal with a down-round. It can become a highly sensitive situation if you’re the investor causing a down-round. But when the markets tank, early-stage investors will have no choice — and this is a possibility in the very near future for current companies.

In today’s economic conditions, investors are

fucked

in bubble-ish sectors because there are enough investors out there that don’t believe in the principles of the power law. They believe they will be the lucky ones to invest into the next billion dollar startup. As a result, they are driving down the ROIs for all investors by funding companies at stratospheric valuations. Sure, this is benefiting the entrepreneurs, but the valuation tide can turn quickly — resulting in down-rounds like after the first internet bubble. Unfortunately, I expect higher valuations to continue for a little longer.

However, this is not 1999 because companies today have a lot more traction than companies did in late 90s and early 2000s. Still, my math is having a hard time supporting these sky-high valuations — especially in Silicon Valley. Power law teaches you there can’t be 100 companies in Silicon Valley with billion dollar valuations. The likelihood of a venture becoming another Facebook or Google is

against

entrepreneurs and investors.

Will we find another Facebook-type monster startup in the future? Sure, but the question is when?

Brain Candy: questions to consider and ponder

(Q1)

Do you think power law applies to early-stage investing?

(Q2)

Do you think there will be another Google, Facebook, Twitter or LinkedIn any time soon?

Entrepreneur

Myth 58

| You can’t build a billion dollar company overnight

During the first internet revolution, I thought it was possible to build a billion dollar company — basically overnight, give or take two to three years. After the bubble popped, I saw entrepreneurs, who'd made a fortune, turn to dust. My attitude changed after my own venture capital fund collapsed, and I stopped thinking it was possible to build a billion dollar empire overnight. What do I think today? I'm back to thinking as I originally thought. Find out why I’m more optimistic and why this myth could still be a myth or might be outdated.

(TO RECEIVE A FREE

DOWNLOAD

OF THIS CHAPTER, PLEASE REGISTER AT ENTREPRENEURDEX.COM THEN SEND AN EMAIL REQUEST TO [email protected])

Entrepreneur

Myth 59

| Bubblepreneur: Party like it’s 1999

Is it a high-tech bubble like 1999 again? Like assholes, everyone has an opinion. I have an opinion too. Is the current bubble a myth or is high tech dealing with different dynamics? Could this be a bubble wearing a different mask? Find out my perspective on bubbles, because I was there when the DotCom Bubble popped in 2001.

(TO RECEIVE A FREE

DOWNLOAD

OF THIS CHAPTER, PLEASE REGISTER AT ENTREPRENEURDEX.COM THEN SEND AN EMAIL REQUEST TO [email protected])

Entrepreneur

Myth 60

| Pets@office is not professional

Pets@office? I used to think bringing pets to the office was unprofessional — until I met Zeke. Zeke converted me into what I call a zooprenuer — an entrepreneur who brings their pet to the office. The first time I met Zeke was when we got him from a rescue group. Of course, I was the last to know we had just adopted a new member to the family.

I recall the day vividly. I was working in my home office in Silicon Valley, when my daughter walked into the house and said, “Look Daddy, look daddy, it’s my new dog.” I smiled and rolled my eyes and said, “Thanks for letting me have some say here.” I turned around and got back to my computer. You see, I was never really a dog lover. I preferred cats. I would have said no to a dog — for sure.

After a few weeks of getting adjusted to having a dog, I got to know Zeke. I started to like this damn dog. What’s not to like about a dog that looks like a wolf? He hung around my feet like Velcro. The name given to him by the rescue organization was Ezekiel, a Biblical name, but it was easier to call him Zeke. Zeke was not your ordinary Alaskan malamute/mix. We suspected he was actually part wolf.

Within a month, my eight-year-old daughter lost interest in taking care of Zeke. Her responsibilities narrowed down to petting him or annoying him. In other words, I got stuck taking care of Zeke because I was the one that stayed up late at night — working long hours. When I worked in my home office, dealing with portfolio companies, Zeke was right there with me. He laid at my feet for most of the night. If I moved, he moved. If I blinked, he blinked. If I smiled, he smiled. Even when I had to go the bathroom, Zeke would follow me to the door and wait for me to finish my business. I was his alpha dog.

Other books

Tempt Me at Midnight by Maureen Smith

My Southern Journey by Rick Bragg

Don't Tell the Wedding Planner by Aimee Carson

The Avenger 11 - River of Ice by Kenneth Robeson

1 Death Pays the Rose Rent by Valerie Malmont

A Breath of Frost by Alyxandra Harvey

The Serpent's Bite by Warren Adler

Agatha Christie's True Crime Inspirations by Mike Holgate

The Radio Magician and Other Stories by James van Pelt