Fooling Some of the People All of the Time, a Long Short (And Now Complete) Story, Updated With New Epilogue

Authors: David Einhorn

Tags: #General, #Investments & Securities, #Business & Economics

Contents

Introduction: The Spark of a Speech

Part One: A Charity Case and Greenlight Capital

Chapter 2: Getting the “Greenlight”

Chapter 3: Greenlight’s Early Successes

Chapter 4: Value Investing through the Internet Bubble

Chapter 5: Dissecting Allied Capital

Part Two: Spinning So Fast Leaves Most People Dizzy

Chapter 7: Wall Street Analysts

Chapter 8: The You-Have-Got-to-Be-Kidding-Me Method of Accounting

Chapter 10: Business Loan Express

Chapter 11: Disengaging and Re-engaging

Chapter 12: Me or Your Lyin’ Eyes?

Chapter 13: Debates and Manipulations

Chapter 14: Rewarding Shareholders

Chapter 15: BLX Is Worth What, Exactly?

Part Three: Would Somebody, Anybody, Wake Up?

Chapter 16: The Government Investigates

Chapter 18: A Spinner, a Scribe, and a Scholar

Chapter 20: Rousing the Authorities

Chapter 21: A $9 Million Game of Three-Card Monte

Part Four: How the System Works (and Doesn’t)

Chapter 22: Hello, Who’s There?

Chapter 25: Another Loan Program, Another Fraud

Chapter 26: The Smell of Politics

Chapter 27: Insiders Getting the Money Out

Part Five: Greenlight Was Right . . . Carry On

Chapter 28: Charges and Denials

Chapter 29: Charges and Admissions

Chapter 31: The SEC Finds a Spot under the Rug

Chapter 33: A Conviction, a Hearing, and a Dismissal

Chapter 34: Blind Men, Elephants, Möbius Strips, and Moral Hazards

Chapter 35: Looking Back: As the Story Continued

Chapter 36: The Lehman Brothers Saga

Chapter 37: If They Asked Me, I Could Write a Book

Chapter 38: Just Put Your Lips Together and Blow

Chapter 39: Some Final Words to and from the SEC

Fooling

Some

of the People

All

of the Time

Copyright © 2008, 2011 by David Einhorn. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey

Published simultaneously in Canada

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at

www.copyright.com

. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at

www.wiley.com/go/permissions

.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our Web site at

www.wiley.com

.

Library of Congress Cataloging-in-Publication Data

Einhorn, David.

Fooling some of the people all of the time : a long, short (and now complete) story/David Einhorn; foreword by Joel Greenblatt.

p. cm.

Includes index.

ISBN 978-0-470-07394-0 (cloth); ISBN 978-0-470-48154-7 (paper); ISBN 978-0-470-37149-7 (ebk); ISBN 978-0-470-37158-9 (ebk); ISBN 978-0-470-89329-6 (ebk)

1. Allied Capital—Management—Evaluation. 2. Allied Capital—Accounting—Evaluation. 3. Small business investment companies—United States—Management—Evaluation. I. Title.

HG3729.U5E44 2008

332.6'20973—dc22

2008011992

In honor of my parents, Stephen and Nancy Einhorn, who demonstrated business success while maintaining high standards of personal integrity and good humor.

Foreword

You don’t have to be a financial expert to read a great detective novel. But since this story involves billions of dollars and an elaborate plan, it does help to have one of the world’s greatest investors around to lead you through all the twists and turns. In the end, the story is simple. It’s also thrilling and scary—even more so because, sadly, this isn’t a novel. It all actually happened, and as I write, the story continues.

I read this book in two sittings. If eating and sleeping hadn’t gotten in the way, it would have been one. I was drawn into a world that few of us have experienced other than at the movies. It really is hard to believe how the legal system, government regulators, and the financial press can all come together and fail so miserably. Most great stories have good guys and bad guys. In simplest form, there are black hats and white hats, and you can tell which side the players are on. Not so in

Fooling Some of the People All of the Time

. Our hero is never quite sure whom he can trust.

But that’s okay. As long as you can experience the excitement and intrigue vicariously in the comfort of a bed or couch, it doesn’t seem so bad. It’s also not so bad to lose some innocence about how the world sometimes works. In the short run, the good guys may get dragged through the mud and the bad guys may get away with millions. But in the long run, the good guys may get dragged through the mud and the bad guys may get away with millions. In the meantime, I will have to give the movie version of the book an R rating. I just don’t want my kids to lose their innocence too soon.

Joel Greenblatt

SEC lawyer:

“At the time that you made the speech, did you anticipate that your position on Allied would become so public, or was it your thought that you would give this speech, say what you thought about the company, and then that would sort of be it, and what would happen to the stock would happen to the stock?”

David Einhorn:

“If what you’re asking is did I feel that the reaction was much, much greater than I would have anticipated? The answer is

yes

.”

Open and consistent accounting starts with an attitude of zero tolerance for improprieties. People need to see that people are rewarded for candor in reporting and punished for slipshod practices. The CEO really has to set the moral tone. Without that, nothing happens.

There’s enormous pressure on public companies to maintain quarterly earnings momentum, and it’s probably growing worse. The bigger thing that firms get punished for are surprises, particularly negative ones. It’s better to face up to bad facts and reporting the business as it is, rather than trying to hide things and make it far worse later on.

If you develop a reputation for candor with securities analysts and investors, that’s about the best you can do. At the end of the day, investors understand that building a business is not an uninterrupted, smooth road. First, you have to determine whether it’s a systematic problem or a people problem. If there’s a dishonest person involved, you get rid of the person.

—Bill Walton, CEO of Allied Capital, 1999

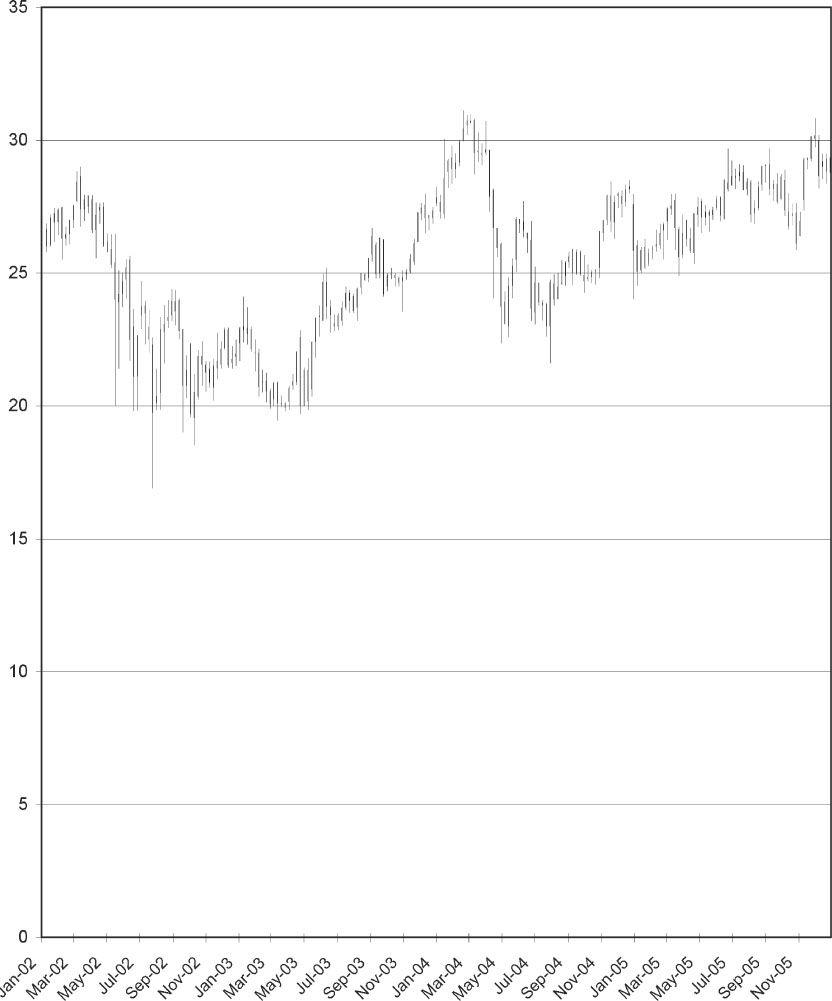

Allied Capital Stock Price 2002-2005

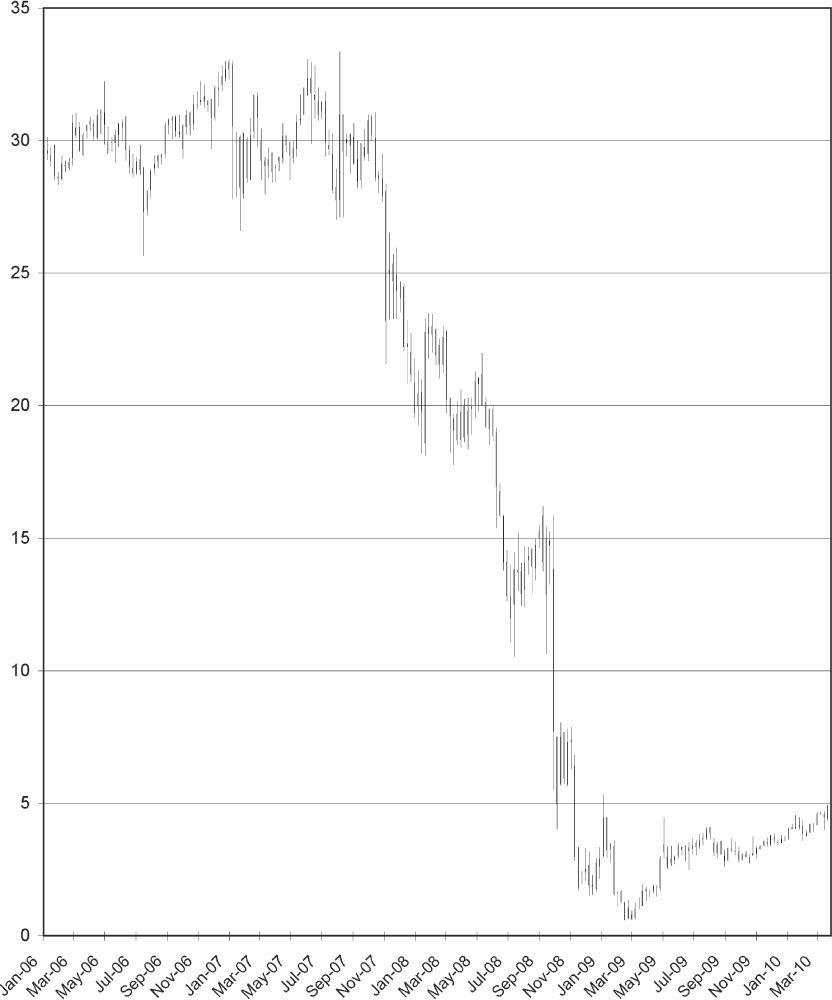

Allied Capital Stock Price 2006-2010