Keeping Your Head After Losing Your Job (12 page)

Read Keeping Your Head After Losing Your Job Online

Authors: Robert L. Leahy

The past person is irrelevant

I have found that the ultimate resolution of the revenge trap is to make the past person irrelevant to your current and future goals. Once you get to the point of thinking and feeling, “They aren’t relevant to my life anymore,” you are freed from the past, freed from the anchor that will sink you in despair, and free to move on to a productive and empowered life where you make choices, you are in charge and you can make things happen.

SUMMARY

It’s natural to feel like a victim when, in fact, you have been a victim. It’s natural to want validation, to complain and even to want to seek revenge. This is part of being human. It’s a most basic emotional response to personal attack, injury, or humiliation. The delicate balance is to validate your right to your feelings and your ability to change your life. I think of our responses as following stages: First, noticing that you have been fired is painful; second, feeling angry, resentful and realizing that you want to seek revenge; and, third, deciding whether you move on to the next stage in your life—to be empowered and to accomplish valued goals.

Validate the unfairness:

It’s important to treat yourself like a human being who has understandable emotions and expects to be treated unfairly. It does feel bad when we are treated unfairly and it’s important to validate that for yourself. But it’s also important to live your life after the event has happened—not to continue to get stuck in what happened to the exclusion of coping with the difficult realities that you need to confront today

Are you thinking like a victim?

Be honest and recognize if you are overly dwelling on how you are a victim. Are you focused on the past, ruminating and repeating to yourself how unfair things are, blaming almost everything on the situation you are in and the people who put you in this predicament? Are you reluctant to change and cope because you think it’s not your fault, so why should you have to change?

Empowering yourself:

thinking about Means and Ends. It’s natural at times to feel like a victim, but it’s much more adaptive to take the next step: to empower yourself. Personal empowerment means that you focus on goals, purpose and plans, you carry out difficult behavior, you are willing to invest in discomfort and delay gratification to pursue your goals, and you are willing to be flexible and adaptive in coping with a realistic problem.

Turn off revenge:

You are human and may have feelings that you want to seek revenge, but focusing on your enemy only deprives you of focusing on positive goals. Examine the costs and benefits of focusing on revenge and ask yourself if your primary goal is to fix the problem or fix the blame.

The empowered choice

is to bounce back from unfairness and build your life as best you can. Unfairness is an unfortunate part of reality and some people suffer more than others. But you can gain more positives by building your life than on getting stuck with what has happened to you. It may be hard at times—and you may rightly think that you should not be in this situation. But building your life means coping with what is—not the way things should be.

Overcoming obstacles

means that you eventually leave them behind. You have problems to solve, goals to achieve, plans to carry out, a present and future to live. If you look at life now as coping with problems and overcoming obstacles you will find that the past recedes as you engage more fully in your life now. The next step should carry you forward, not backward.

7

MIND OVER MONEY

“How am I going to take care of my family?” Brian said, worried that his life was falling apart now that he had lost his job. He did have a small amount of severance money. Kathy, his wife, worked part time, but that wasn’t going to be much money for them to live on. They relied on his income. With two children and a credit card payment due, it looked pretty bleak. Money was a real issue for Brian and Kathy, and they both shared their worries about how they would get through this difficult time.

Most people who lose their jobs will suffer a financial setback. It’s the rare person who has a large financial parachute that can provide a soft landing. For many, there is a small amount of severance pay—or just the final month’s earnings—followed by reliance on benefits and savings. Many people will get into greater debt during this time between jobs. If you are the breadwinner, you will feel the added burden of this responsibility, often thinking that you won’t be able to take care of your family and blaming yourself for letting them down. These are perfectly human sentiments and come from your honorable motives to be responsible and to help your family.

Our emotional connection to money

Money has emotional significance to us. It often represents success, status, responsibility, security and freedom. But we may tend to over-value money and equate ourselves with how much we have and how much we make. After all, people kill other people because of their desire for money. We will examine how you can change your relationship to money and the meaning of money in your life so that money becomes less a source of depression, anxiety, and helplessness while you expand the meaning of your life and recognize that there are many experiences, behaviors, and relationships that do not involve money. In fact, I have found that a lot of my clients who overvalued money learned during their time between jobs that they just were not focused on the right things and the right values. That lesson helped them to make their lives during and after the period of unemployment more meaningful and more filled with awareness and appreciation.

Looking at money through different eyes

In this chapter we will look at the reality about your financial situation, how you might start saving money now (by reducing expenses), and how you can prioritize which expenses are important and which are actually unnecessary. We will look at your attitude towards money, how it is tied to your sense of security, your status and self-esteem, and we will consider how you might change the way money functions in your life. Although money is a reality—and money does buy things that are important—we will examine how some of the more important things in your life might not cost very much, or might even be free. And we will look at how this more difficult time in your life might help you to establish more human values—values that are based less on materialism, less on things, and more on the meanings that you give to your relationships, your purpose in life, and the things that matter.

There are a lot of ways of helping your family—and of

being there

for them. Let’s take a look at how your financial issues affect you and how you can handle them. And let’s keep in mind that supporting your family is not the same thing as your paycheck. You are more than a paycheck.

1: Get the information

I continue to be amazed at how often people are upset about their finances, although they actually don’t have the information available regarding how much they have, what they spend, and what they need. Money is one of the most emotional issues that we all contend with—all the more reason to get the facts. There are several kinds of facts that you need to grasp:

Savings:

You need to look at how much you have in savings—both you and your partner. You may have a savings account, stocks and shares, or property, you may own one or two cars, you could have jewelry, and you might have a private pension. Whatever information about your assets that you would provide in applying for a mortgage is important information for you to look at now. Get the information together and share it openly with your partner. There should be no secrets. You are on the same team.

Expenses:

Collect the information from your prior expenses for the last two months—including all credit card expenses that you can lay your hands on, details of your rent or mortgage, local taxes and other recurring bills such as electricity, gas, and telephone.

Accounting:

Start keeping track of how you spend your money. For the next three weeks, you and your partner should keep a daily record of all expenses—checks, cash, debit and credit card use. Itemize each expense. Many people find that they are repeatedly spending small amounts that can add up to a lot more than you would think. A simple example might be buying coffee.

Let’s say that you buy a cup of coffee at Starbucks every day for one year—price, $3.50 per cup. That comes to $1277 per year. If you brewed your own at .25 cents per cup you would spend $91 per year. This is a savings of $1186 per year. The same with buying lunch; if you saved $5 per lunch for five days, you would save about $100 per month. And you might eat more healthy food if you made your own lunch. These bills add up.

There are a number of sources of information about your expenses, including your paycheck records, your prior income tax returns, your bank statements, credit card bills, and any other information from your bank or investment records. Look at major purchases—such as a car—that would be something you might not buy for another five or six years. Since you are unlikely to have records of your cash payments, this will be something that you will have to start recording to get a better sense of where your money is going.

In any case, keep a budget of where you are spending your money. Think about which expenses are necessary and which are not. When possible, delay purchasing something—consider whether you really need it, whether there is a cheaper alternative, or whether you can get it later when your finances are more secure.

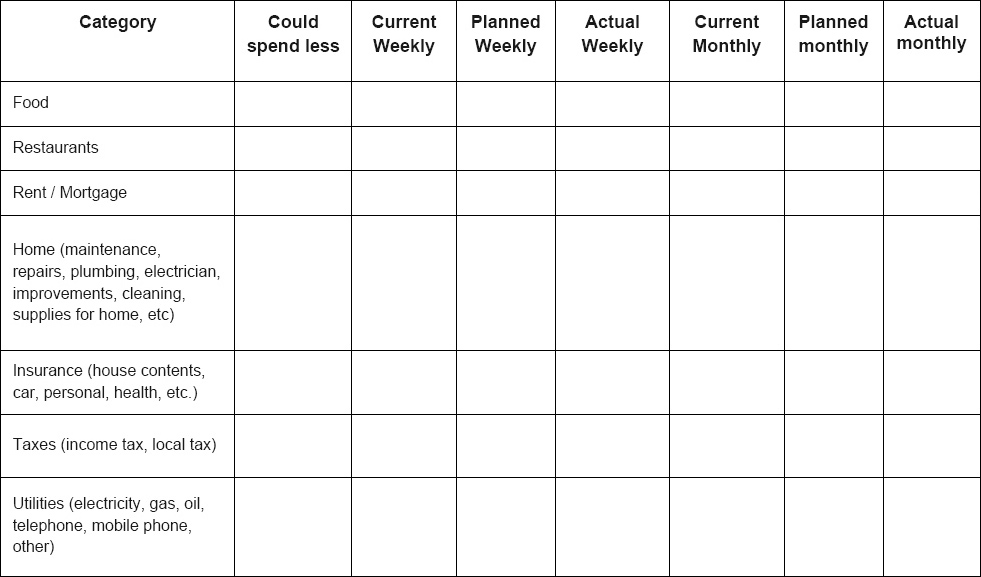

Use the chart below to keep track of your outgoings—or as a template to copy into your notebook.

| Category | Weekly | Monthly |

| Food | | |

| Restaurants | | |

| Rent/mortgage | | |

| Home (maintenance, repairs, plumbing, electrician, improvements, cleaning, supplies for home, etc) | | |

| Insurance (house contents, car, personal, health, etc.) | | |

| Taxes (income tax, local tax) | | |

| Utilities (electricity, gas, oil, telephone, mobile phone, other) | | |

| Entertainment (films, sporting events, other) | | |

| Clothes | | |

| Transportation (train, bus, taxis, gas, etc.) | | |

| Car (Maintenance, parking, tolls) | | |

| Personal (Haircuts, makeup, self-care) | | |

| Hobbies | | |

| Communication | | |

| Recreation | | |

| Supplies | | |

| Child care | | |

| Pets | | |

| Gifts | | |

| Charitable donations | | |

| Payments on loans | | |

| Credit card payments | | |

| Education (tuition, private schooling, books, training, tutors) | | |

New sources of income:

Collect information about sources of income. I know you lost your job, so that might be what you are focused on right now. But get the best information that you can about other sources of income. This might include any unemployment benefits (and how long you can get them), your partner’s income, interest on savings, and other sources, if there are any. For most people, unemployment is a temporary setback—so you might be back earning a living in a month or two. But you cannot count on it, so try to look at the short term and the long term. Use the table below to compile your information.

| Income | |

| Unemployment benefits | |

| Interest on investments | |

| Income from other family members | |

| Other sources of income | |

| Assets | |

| Private pension | |

| Savings | |

| Stocks and bonds | |

| Property (main) | |

| Car(s) | |

| Other properties | |

| Jewelry | |

| Other assets | |

2: Consider where you can budget

One way of thinking about how you spend money is to categorize your expenses into needs and wants. Needs are expenses such as rent or mortgage, wants are those flexible and unnecessary expenses, such as the Starbucks coffee, the taxi, the latest electronic gadget, or other “preferences” that you really don’t need.

As I indicated above, there are a number of items you can save on. These include repeated expenses, unnecessary purchases, and things that you buy only because of convenience or because you are driven by impulse. Make your shopping and buying more mindful, more frugal, more strategic. Why give other people your money, when you can save it for yourself?

Consider your phone bills—and your bills on your mobile phone or internet. Think about your subscription to cable television channels. Think twice before buying something. Just because you go into a store, it doesn’t mean that you have an obligation to buy something. Just because you think something is a bargain, it doesn’t mean you need it. How many pieces of clothing, or items that you have purchased in the past, are sitting around in your house that you never wear or use? We are drowning in unnecessary expenses.

Change your mindset about budgeting

Some people strongly resist keeping a budget and trying to save. They say, “I don’t want to deprive myself,” or “I don’t want to feel poor.” It’s as if spending money foolishly is a sign of success. I recall a number of years ago I had a client who was very wealthy. He owned companies across the US. I commented: “That’s a nice jacket you have on.”

“Yes,” he said, “they had a great sale at the store.”

“You look for sales?”

“Of course I do. I never pay full price. I always look for a bargain.”

This really impressed me. I realized that he had the same strategy in his business—always looking for ways to save money, always looking for a bargain. He was rich because he bought bargains. Buy low, sell high.

It’s a good practice no matter what. You are very likely throwing away a lot of money. You don’t need to.

A budget means less guilt when you buy

Interestingly, in developing a budget—finding out what you are spending and what you can afford—can allow you to make purchases with less guilt. A lot of people who are unemployed become extremely anxious about spending any money. You can get upset—or your partner can be upset—if you make a purchase that doesn’t seem absolutely necessary. You might get into an argument about buying a tuna sandwich or a scarf. But the purpose of a budget is not to eliminate all expenses—or even all unnecessary expenses. It’s to let you know what the information is. So budgeting can actually give you “permission” for purchasing things you don’t need, because you can plan for some of these expenses in your budget. Your budget should help you find your balance, not deprive you of everything you want.

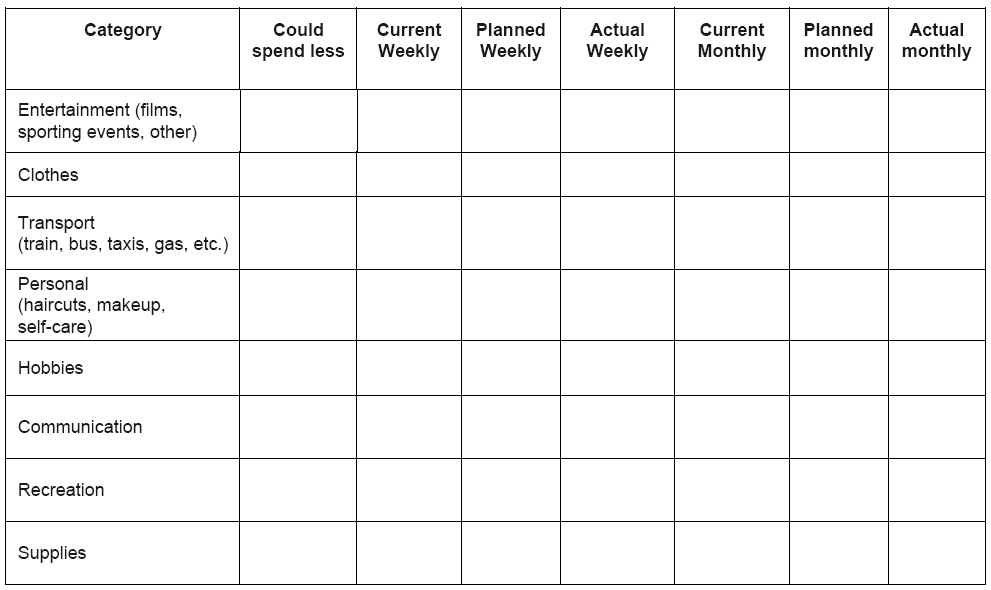

Using the table below, based on the information from

Keep a Budget

, think how you might plan to spend less. Put a tick next to each category where you might consider spending less. In the right-hand columns, indicate if this is a flexible expense (one that you can reduce without suffering a decline in your quality of life), and how much less you can aim for. Then indicate what your goal would be for this week (or month) and then keep track of what you actually spend. You might find that this targeted budget plan can produce real savings. (Don’t forget, you can copy this information into your notebook if you’d rather not write down here.)

Planning on Reducing Expenses