Read Antifragile: Things That Gain from Disorder Online

Authors: Nassim Nicholas Taleb

Antifragile: Things That Gain from Disorder (86 page)

The Antifragile: An Introduction

Antifragility and complexity:

Bar-Yam and Epstein (2004) define sensitivity, the possibility of large response to small stimuli, and robustness, the possibility of small response to large stimuli. In fact this sensitivity, when the response is positive, resembles antifragility.Private Correspondence with Bar-Yam:

Yaneer Bar-Yam, generously in his comments: “If we take a step back and more generally consider the issue of partitioned versus connected systems, partitioned systems are more stable, and connected systems are both more vulnerable and have more opportunities for collective action. Vulnerability (fragility) is connectivity without responsiveness. Responsiveness enables connectivity to lead to opportunity. If collective action can be employed to address threats, or to take advantage of opportunities, then the vulnerability can be mitigated and outweighed by the benefits. This is the basic relationship between the idea of sensitivity as we described it and your concept of antifragility.” (With permission.)Damocles and complexification:

Tainter (1988) argues that sophistication leads to fragility—but following a very different line of reasoning.Post-Traumatic Growth:

Bonanno (2004), Tedeschi and Calhoun (1996), Calhoun and Tedeschi (2006), Alter et al. (2007), Shah et al. (2007), Pat-Horenczyk and Brom (2007).Pilots abdicate responsibility to the system:

FAA report: John Lowy, AP, Aug. 29, 2011.Lucretius Effect:

Fourth Quadran

t

discussion in the Postscript of

The Black Swan

and empirical evidence in associated papers.High-water mark:

Kahneman (2011), using as backup the works of the very insightful Howard Kunreuther, that “protective actions, whether by individuals or by governments, are usually designed to be adequate to the worst disaster actually experienced.… Images of even worse disaster do not come easily to mind.”Psychologists and “resilience”:

Seery 2011, courtesy Peter Bevelin. “However, some theory and empirical evidence suggest that the experience of facing difficulties can also promote benefits in the form of greater propensity for resilience when dealing with subsequent stressful situations.” They use resilience! Once again

itsnotresilience

.Danchin’s paper:

Danchin et al. (2011).Engineering errors and sequential effect on safety:

Petroski (2006).Noise and effort:

Mehta et al. (2012).Effort and fluency:

Shan and Oppenheimer (2007), Alter et al. (2007).Barricades:

Idea communicated by Saifedean Ammous.Buzzati:

Una felice sintesi di quell’ultimo capitolo della vita di Buzzati è contenuto nel libro di Lucia Bellaspiga «Dio che non esisti, ti prego. Dino Buzzati, la fatica di credere»Self-knowledge:

Daniel Wegner’s illusion of conscious will, in

Fooled by Randomness

.Book sales and bad reviews:

For Ayn Rand: Michael Shermer, “The Unlikeliest Cult in History,”

Skeptic

vol. 2, no. 2, 1993, pp. 74–81. This is an example; please do not mistake this author for a fan of Ayn Rand.Smear campaigns:

Note that the German philosopher Brentano waged an anonymous attack on Marx. Initially it was the accusation of covering up some sub-minor fact completely irrelevant to the ideas of

Das Kapital;

Brentano got the discussion completely diverted away from the central theme, even posthumously, with Engels vigorously continuing the debate defending Marx in the preface of the third volume of the treatise.How to run a smear campaign from Louis XIV to Napoleon:

Darnton (2010).Wolff’s law and bones, exercise, bone mineral density in swimmers:

Wolff (1892), Carbuhn (2010), Guadaluppe-Grau (2009), Hallström et al. (2010), Mudd (2007), Velez (2008).Aesthetics of disorder:

Arnheim (1971).Nanocomposites:

Carey et al. (2011).Karsenty and Bones:

I thank Jacques Merab for discussion and introduction to Karsenty; Karsenty (2003, 2012a), Fukumoto and Martin (2009); for male fertility and bones, Karsenty (2011, 2012b).Mistaking the Economy for a Clock:

A typical, infuriating error in Grant (2001): “Society is conceived as a huge and intricate clockwork that functions automatically and predictably once it has been set in motion. The whole system is governed by mechanical laws that organize the relations of each part. Just as Newton discovered the laws of gravity that govern motion in the natural world, Adam Smith discovered the laws of supply and demand that govern the motion of the economy. Smith used the metaphor of the watch and the machine in describing social systems.”Selfish gene:

The “selfish gene” is (convincingly) an idea of Robert Trivers often attributed to Richard Dawkins—private communication with Robert Trivers. A sad story.Danchin’s systemic antifragility and redefinition of hormesis:

Danchin and I wrote our papers in feedback mode. Danchin et al. (2011): “The idea behind is that in the fate of a collection of entities, exposed to serious challenges, it may be possible to obtain a positive overall outcome. Within the collection, one of the entities would fare extremely well, compensating for the collapse of all the others and even doing much better than the bulk if unchallenged. With this view, hormesis is just a holistic description of underlying scenarios acting at the level of a population of processes, structures or molecules, just noting the positive outcome for the whole. For living organisms this could act at the level of the population of organisms, the population of cells, or the population of intracellular molecules. We explore here how antifragility could operate at the latter level, noting that its implementation has features highly reminiscent of what we name natural selection. In particular, if antifragility is a built-in process that permits some individual entities to stand out from the bulk in a challenging situation, thereby improving the fate of the whole, it would illustrate the implementation of a process that gathers and utilises information.”Steve Jobs:

“Death is the most wonderful invention of life. It purges the system of these old models that are obsolete.” Beahm (2011).Swiss cuckoo clock:

Orson Welles,

The Third Man.Bruno Leoni:

I thank Alberto Mingardi for making me aware of the idea of legal robustness—and for the privilege of being invited to give the Leoni lecture in Milan in 2009. Leoni (1957, 1991).Great Moderation:

A turkey problem. Before the turmoil that started in 2008, a gentleman called Benjamin Bernanke, then a Princeton professor, later to be chairman of the Federal Reserve Bank of the United States and the most powerful person in the world of economics and finance, dubbed the period we witnessed the “great moderation”—putting me in a very difficult position to argue for increase of fragility. This is like pronouncing that someone who has just spent a decade in a sterilized room is in “great health”—when he is the most vulnerable.

Note that the turkey problem is an evolution of Russell’s chicken (

The Black Swan

).Rousseau:

In

Contrat Social

. See also Joseph de Maistre,

Oeuvres,

Éditions Robert Laffont.

Modernity and the Denial of Antifragility

City-states:

Great arguments in support of the movement toward semiautonomous cities. Benjamin Barber, Long Now Foundation Lecture (2012), Khanna (2010), Glaeser (2011). Mayors are better than presidents at dealing with trash collection—and less likely to drag us into war. Also Mansel (2012) for the Levant.Austro-Hungarian Empire:

Fejtö (1989). Counterfactual history: Fejtö holds that the first war would have been avoided.Random search and oil exploration:

Menard and Sharman (1976), controversy White et al. (1976), Singer et al. (1981).Randomizing politicians:

Pluchino et al. (2011).Switzerland:

Exposition in Fossedal and Berkeley (2005).Modern State:

Scott (1998) provides a critique of the high modernistic state.Levantine economies:

Mansel (2012) on city-states. Economic history, Pamuk (2006), Issawi (1966, 1988), von Heyd (1886). Insights in Edmond About (About, 1855).City-States in history:

Stasavage (2012) is critical of the oligarchic city-state as an engine of long-term growth (though initially high growth rate). However, the paper is totally unconvincing econometrically owing to missing fat tails. The issue is fragility and risk management, not cosmetic growth. Aside from Weber and Pirenne, advocates of the model, Delong and Schleifer (1993). See Ogilvie (2011).Tonsillectomies:

Bakwin (1945), cited by Bornstein and Emler (2001), discussion in Freidson (1970). Redone by Avanian and Berwick (1991).Orlov:

Orlov (2011).Naive interventionism in development:

Easterly (2006) reports a green lumber problem: “The fallacy is to assume that because I have studied and lived in a society that somehow wound up with prosperity and peace, I know enough to plan for other societies to have prosperity and peace. As my friend April once said, this is like thinking the racehorses can be put in charge of building the racetracks.”

Also luck in development, Easterly et al. (1993), Easterly and Levine (2003), Easterly (2001).China famine:

Meng et al. (2010).Washington’s death:

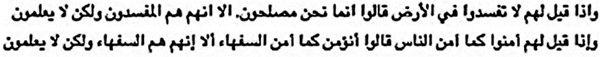

Morens (1999); Wallenborn (1997).KORAN and Iatrogenics:

Semmelweiss:

Of the most unlikely references, see Louis-Ferdinand Céline’s doctoral thesis, reprinted in Gallimard (1999), courtesy Gloria Origgi.Fake stabilization:

Some of the arguments in

Chapter 7

were co-developed with Mark Blyth in

Foreign Affairs,

Taleb and Blyth (2011).Sweden:

“Economic elites had more autonomy than in any successful democracy,” Steinmo (2011).Traffic and removal of signs:

Vanderbilt (2008).History of China:

Eberhard (reprint, 2006).Nudge:

They call it the

status quo bias

and some people want to get the government to manipulate people into breaking out of it. Good idea, except when the “expert” nudging us is not an expert.Procrastination and the priority heuristic:

Brandstetter and Gigerenzer (2006).France’s variety:

Robb (2007). French riots as a national sport, Nicolas (2008). Nation-state in France, between 1680 and 1800, Bell (2001).Complexity:

We are more interested here in the effect on fat tails than other attributes. See Kaufman (1995), Hilland (1995), Bar-Yam (2001), Miller and Page (2007), Sornette (2004).Complexity and fat tails:

There is no need to load the math here (left to the technical companion); simple rigorous arguments can prove with minimal words how fat tails emerge from some attributes of complex systems. The important mathematical effect comes from lack of independence of random variables which prevents convergence to the Gaussian basin.

Let us examine the effect from dynamic hedging and portfolio revisions.

A—Why fat tails emerge from leverage and feedback loops, single agent simplified case.A1 [leverage]—If an agent with some leverage L buys securities in response to increase in his wealth (from the increase of the value of these securities held), and sells them in response to decrease in their value, in an attempt to maintain a certain level of leverage L (he is concave in exposure), and

A2 [feedback effects]—If securities rise nonlinearly in value in response to purchasers and decline in value in response to sales, then, by the violation of the independence between the variations of securities, CLT (the central limit theorem) no longer holds (no convergence to the Gaussian basin). So fat tails are an immediate result of feedback and leverage, exacerbated by the concavity from the level of leverage L.

A3—If feedback effects are concave to size (it costs more per unit to sell 10 than to sell 1), then negative skewness of the security and the wealth process will emerge. (Simply, like the “negative gamma” of portfolio insurance, the agent has an option in buying, but no option in selling, hence negative skewness. The forced selling is exactly like the hedging of a short option.)

Note on path dependence exacerbating skewness:

More specifically, if wealth increases first, this causes more risk and skew. Squeezes and forced selling on the way down: the market drops more (but less frequently) than it rises on the way up.B—Multiagents: if, furthermore, more than one agent is involved, then the effect is compounded by the dynamic adjustment (hedging) of one agent causing the adjustment of another, something commonly called “contagion.”

C—One can generalize to anything, such as home prices rising in response to home purchases from excess liquidity, etc.

The same general idea of forced execution plus concavity of costs leads to the superiority of systems with distributed randomness.