Don't Break the Bank: A Student's Guide to Managing Money (11 page)

Read Don't Break the Bank: A Student's Guide to Managing Money Online

Authors: Peterson's

Tags: #Azizex666

Hosting (being the front-of-house person who shows customers to their seats, makes a waiting list, etc.) is another good way to be earning extra money without the time and effort that being a server often requires. A friendly attitude, organization skills, and time management are all necessary components of being an effective host.

Unless you are a server or a bartender, restaurant jobs can be a great way to supplement other jobs or school-life because the time commitment is generally not too demanding and it is a great way to get some experience and extra money.

As with any job, responsibility for your role is key and must be treated with an air of professionalism. Do not forget to call before you’re going to be late or not make a shift; do everything you can to find someone to cover your shift; and be upfront about when you’ll be able to work and the time when you know you won’t be able to work. Dress appropriately. Do not alienate yourself from your fellow staff—they are your peers and your (potential) friends.

Retail Jobs: Time for the Big Sale

Working at a store is a popular job choice for many teens. For one thing, many young people spend a lot of their time at the mall or other stores anyway, so they figure they may as well get paid for it. However, that attitude can often backfire on you. There’s a big difference between hanging out at The Gap and working there. In fact, employers are often afraid of hiring teens who seem eager to just hang out and chat with friends on company time.

Retail jobs can offer a chance for promotion. In many instances, workers who are lower on the totem pole can become managers and supervisors, meaning more responsibility and trust and (often) more money. You can often climb the company ladder fairly quickly, depending on how flexible and hard-working you are. You will earn points by showing your willingness to do whatever you are assigned to, whether it’s folding sweaters, shelving books, bagging groceries, or vacuuming the store. It’s important to take pride in your work and be efficient while remaining thorough and friendly.

Many retail jobs require workers to observe some sort of dress code, and you shouldn’t ignore this. In many cases, you can use a little creativity to be stylish and unique while still adhering to the dress code.

Big stores often require an official application and some sort of interview process as well as references. Teachers, neighbors, pastors, coaches, and band leaders are all good sources for recommendations. Do not be scared off by the application; if there is a high degree of professionalism and an official nature to the process, it often means that there is a set wage in place and less of a chance of being taken advantage of. Also, big stores often have bonuses and scholarship programs for kids in high school, which is basically like being recognized for earning money for college, and then being given more money to put towards college. This can be a great perk.

As with any job, take a retail job seriously and be enthusiastic and willing to accomplish (conquer!) any task set forth before you.

“Having a car is a major expense for most teens. My parents taught me a great lesson when I was looking to buy my first car. I began working when I was 14 years old. My family owned an appliance business, and I delivered and set up appliances during my summer break. My parents agreed to match the amount I earned, and I could apply this towards my car. Instead of hanging out with my friends all summer, I lifted heavy appliances in the hot Florida sun. I continued to do this in the afternoons once school started. By the time I turned 16, I had saved $2,000! With my parents matching this amount, I had enough to buy a $4,000 car. My grandfather was looking to purchase a new vehicle and was kind enough to sell me his truck for the amount I had. This was my first real understanding of money. I realized that if I worked hard and saved, I could buy something that I desired. I was fortunate that my parents gave me money, but even more fortunate that they made me work to earn this amount. Some of my friends had their cars and other items bought for them by their parents and, let me tell you, they did not treat their possessions like I did mine. I valued what I had because I knew how much sweat had gone into earning it.”

~

Danny Kofke, special education teacher and author of

“A Simple Book of Financial Wisdom: Teach Yourself (and Your Kids) How to Live Wealthy with Little Money”

(Wyatt-MacKenzie, September 2011)

Car Wash—Going to the Car Wash, Yeah!

A car wash offers many of the same pros and cons as yard work (at least, if you are working for an outdoor car wash). It’s definitely hard work, but you will get to be outdoors in nice weather. Outdoor car washes are seasonal businesses, though, since they are often closed during the coldest months. So this may not be a good source of year-round work.

Things to Consider with a Part-Time Job

Tip:

Don’t limit yourself to one part-time job or type of job. You may need to piece together a few gigs in order to get a decent amount of cash in your pocket each week. For example, maybe you can babysit one or two nights a week, mow a few lawns on weekends, and run some errands occasionally in between.

If you are in high school, visit your guidance office to inquire about working papers and whether you will need them (the laws vary from state to state). There are also many laws in place that limit the number of hours and conditions in which teenagers can work, so be sure to know about what your employers can and cannot ask, and whether you will even be allowed to do the jobs you are considering. For example, construction and other hard labor jobs, jobs with large machines and blades, and any jobs that involve being around alcohol are often off-limits for teens.

Going to school and holding a job at the same time can be a great way to learn effective time management, but bear in mind that school needs to take priority. You need to do well in school in order to either continue your education at college or get a good start on a career.

“I started working when I was 15, doing pickup babysitting jobs, lawn jobs, and then waitressing at the local diner on the weekends. This meant that I always had my own money and was not beholden to anyone. But as the pressure from school and extracurricular activities increased, I found myself stretched a little too thin. I asked my mom for advice, and she told me something that I think still rings true for anyone of that age. She said, “School is your job.” Though it sounded glib and tacky at the time, it has rung true time and again throughout college and in the few years beyond. If I had let school suffer for the sake of earning a few dollars, I would not have done well in school, and would not have learned the skills that inform the degree that I use everyday in the job that I got because of my educational background. I held work-study jobs all through college, which gave me discretionary funds, but also forced me to focus because I had to manage my time most efficiently in order to make room for both school and work. But if I had not treated school as seriously as I treated my jobs, I would not have been able to get the good job—with benefits—that I have today.”

~

Railey Savage, age 20-something

Getting Paid (and Being Prepared for Your First Paycheck)

Getting your very first paycheck can be an exciting moment—and it can also be a big shock, as the amount you actually get may be less than what you expected.

When getting the stub from your first paycheck, do not be alarmed by how much money seems to be missing. While it may seem totally unfair, money being deducted from paychecks for things like Social Security and Medicare and taxes, withholding is a required part of work. Depending on your situation and how much money you earn, you or your parents may get some or all of the taxes that were withheld back in the form of a refund from the government when you file a tax return at the end of the year.

If at all possible, it is best to have your paychecks directly deposited in the bank, eliminating the possibility of losing a check, forgetting to deposit it, or giving in to temptation and simply cashing it, rather than depositing it and building up your savings. Many banks also offer special perks if you use

direct deposit

because it’s a sign that you are a guaranteed customer who will be using that account a lot.

Your paycheck is your opportunity to see that your work and time were worth something. Be conscious of how many hours you have worked and whether you called in sick or worked overtime—all of these are factors that affect how much you earn per pay period. You should not be surprised by the amount of your checks.

Be aware that many employers do not like employees to work overtime (there may be laws against teenagers working much more than a certain amount of time, anyway) because they don’t like paying the overtime rates usually required by law. That being said, be sure you are paid for EVERY INSTANCE that you work. You should never be working for free—if you did the work, you deserve to be paid for it.

In the next chapter, we will look at your paycheck in more detail.

Chapter 4

Analyzing Your Paycheck

So you’ve joined the working world and are excited to earn your own money. You count the days until payday and eagerly rip open the envelope with your paycheck (or check your bank balance online)—only to discover with great disappointment that the amount is much less than you had expected.

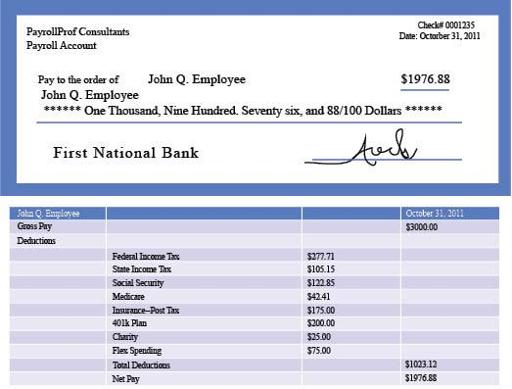

Before you call your employer to say that surely there must have been some sort of mistake, you should take a good look at your paystub. This is the paper that is attached to your paycheck (or, if you get direct deposit, the paper that explains the amount of your deposit).

Be prepared: There may be some abbreviations and terms you’ve never heard of. For example, you may be thinking, “Who the heck is

FICA

and why are they getting a chunk of my check?”

It’s time for a little reality check: The sad, but true, fact is, when you earn money, you rarely actually get the entire amount you earn. There are some exceptions, such as for freelance gigs or in cases where you are paid cash or “under the table.” But most of the time, there will be deductions taken out of your paycheck.

These deductions can be for a variety of things, including taxes, health insurance, and even charity donations.

Working for the Man: Mandatory Deductions

The amount you earn

before

deductions (your hourly rate times the number of hours you work) is called your

gross pay

.

The amount you actually receive

after

deductions is called your

net pay.

There are some deductions that your employer is required to take out of your check. Neither you nor your employer has any choice about this—there is no getting around it.

Mandatory deductions are mainly in the form of taxes. Most likely, you will see several lines of tax deductions on your pay stub. These may include federal, state, and local taxes. (Sometimes, federal and state taxes aren’t deducted if you make less than a certain amount.)

Employees also pay into the Social Security and Medicare programs. These may appear on your pay stub as FICA—which stands for Federal Insurance Contributions Act.

Voluntary Deductions

There are also voluntary deductions, ones that you choose to make. These would include things like health coverage (if your employer offers it) and charity donations.

Source: Roger A. Smith, CPP

www.payrollprof.com

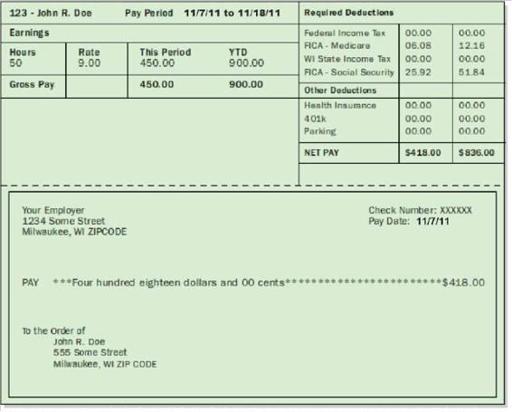

Year-to-Date Totals

Your pay stub will usually include a section with your year-to-date (YTD) totals. This makes it easy to see at a quick glance how much you have earned and paid to taxes so far this year.

Here’s another sample of a pay stub, showing year-to-date totals.