I.O.U.S.A. (11 page)

Authors: Addison Wiggin,Kate Incontrera,Dorianne Perrucci

Tags: #Forecasting, #Finance, #Public Finance, #Economic forecasting - United States, #General, #United States, #Personal Finance, #Economic Conditions, #Economic forecasting, #Finance - United States - History, #Debt, #Debt - United States - History, #Business & Economics, #History

A press conference was held to introduce the organization in front of the National Debt Clock in Times Square.

“ We believe the Concord Coalition will be a powerful grassroots organization that will say to the politicians all 23

c02.indd 23

8/26/08 8:42:26 PM

24 The

Mission

across this country that the American people are ready for truth, ” Paul Tsongas told the group of reporters.

“ Let me be blunt, ” said Warren Rudman, “ the two political parties are unable to speak the truth because the American people frankly don ’ t want to hear it. Because they don ’ t understand it. ”

“ We are now borrowing twenty - two cents of every dollar that we ’ re spending, ” Pete Peterson warned, “ and in effect what we ’ re doing is we ’ re slipping this huge hidden check for our free lunch to our children and our grandchildren.

And you ain ’ t seen nothing yet. ”

The Concord Coalition was founded to warn blissfully unaware American citizens about the growing national debt and fi scal challenges faced by a nation that runs persistent budget defi cits. Based on its mission, it was only natural that it was on the hit list of organizations that we included in our fi lm.

As mentioned previously, one of our main objectives in the early part of the fi lm was to help Americans to understand basic concepts like the difference between a federal

budget defi cit

and the

national debt.

You ’ d be surprised how many otherwise intelligent human beings couldn ’ t begin to tell the difference between the two. We also wanted to warn people that running persistent budget defi cits over a long period of time can be disastrous to the currency — the dollars in your pocket. We fi gured, armed with this freshly minted knowledge, American consumers would be more likely to hold their public offi cials accountable for the decisions they make and the legislation they pass.

Bixby Goes to Washington

“ The Concord Coalition was formed to address the issue of federal debt, ” Bob Bixby says while making his way through the Washington, D.C., subway system, “ so I do feel a particular responsibility to advance the cause. Things like this (like c02.indd 24

8/26/08 8:42:35 PM

Chapter 2 The Budget Defi cit

25

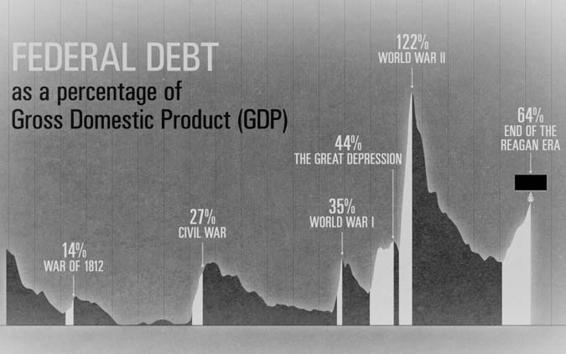

Federal Debt: A Brief History—1776 Through 1992

Today’s federal debt is the sum of the United States’ annual budget defi cits and surpluses going back to the beginning of the Federal government. The country’s War for Independence created much of the early debt, and by March 4, 1789, the fi rst day of the federal government, America’s national debt was $75 million, which was about 30 percent of the economy. This terrifi ed the Founding Fathers and they acted quickly to pay this debt down. By 1835, the federal debt was $0—the only time in America’s history that achievement has been reached.

Of course, the United States didn’t stay there for long. The Civil War not only had a large human cost, it brought the country to the brink of bankruptcy. However, like before, the debt was paid down quickly. In 1913, the Federal Reserve System was created to help manage the nation’s money supply and to oversee national banks. That year also saw the birth of the modern income tax. Several years after the costly fi rst world war, the Great Depression brought with it extreme economic hardship for millions of Americans. The Social Security program was created to help Americans save for the future. World War II was a time of sacrifi ce, and while the government took on unprecedented levels of debt, Americans bought savings bonds to fi nance winning the war.

The large military and social spending practices of the 1960s and 1970s were two key factors that led to a major economic downturn by the 1970s. The 1980s saw the rise of such things as

supply-side economics, Reaganomics,

and the controversial

Laffer curve,

which proposed that lower marginal tax rates would eventually generate higher total tax revenues. The theory did have its critics and the debate over supply-side economics continues to this day. However, what is not debatable is that the federal debt exploded during the 1980s. A fundamental shift had occurred: America was becoming addicted to debt. Never before in the country’s history had so much debt been created during an era of relative peace and prosperity. Yes, the Cold War ended, but this came at an extremely high price, and people from across the political spectrum were becoming very alarmed.

c02.indd 25

8/26/08 8:42:36 PM

26 The

Mission

SOURCE: Compilation from Government Sources/MeasuringWorth.com 1992 FEDERAL DEPT

$4 TRILLION

Figure 2.1

History of the Federal Debt as Percentage of GDP

Source:

Compilation from government sources and MeasuringWorth (www.measuringworth.com).

today ’ s hearing) are just a great opportunity to do so. They don ’ t come along all the time. ”

Senate Budget

Bixby is referring to his testimony before the Senate

Committee:

Budget Committee during a hearing on the long - term fi scal

This committee

health of the federal government.

is responsible

for drafting

In an effort to explain the budget defi cit in an easily

Congress’s annual

understandable way, Bixby uses various metaphors that reso-budget plan and

nate with the average American. First, he likens a budget to

monitoring action

going on a diet. They only way that you can really lose weight

of the budget

is to get more exercise or to eat less. Similarly, there are really

for the federal

government. The

only two ways that you can balance a budget: You can cut

Committee is

spending or you can raise taxes. Not surprisingly, people

chaired by Sen.

don ’ t necessarily like those hard choices so they look for easy

Kent Conrad

solutions.

(D–North Dakota)

Next, he likens the budget committee to that of a family

and the ranking

minority member is

meeting. He says that the committee is like Mom and Dad sit-Sen. Judd Gregg

ting at the kitchen table at the beginning of the year, fi guring

(R–New Hampshire).

out what the family can afford. Everybody comes to the table c02.indd 26

8/26/08 8:42:37 PM

Chapter 2 The Budget Defi cit

27

with their ideas about the new things that the family needs.

Mom and Dad then look at how much income they ’ re going to have that year and how much they can afford to spend.

“ The family hasn

’ t been doing too well,

” Bixby says,

chuckling. “ We ’ ve been running defi cits of two hundred to three hundred billion dollars every year, which is quite a bit of money.

“ I think everybody realizes this sort of a family budget is unsustainable over the long term. At this rate, the family ’ s going to be in a lot of trouble. ”

On this particular occasion, four people were testifying at the Senate Budget Committee hearing: Bob Bixby, of the Concord Coalition; Dr. Stuart Butler, of the Heritage Foundation; Jason Furman, of the Brookings Institution and Barack Obama ’ s chief economic adviser; and Joseph Minarik of the Committee for Economic Development.

Senator Kent Conrad from North Dakota was presiding.

“ One of the major threats to our economy, ” began Senator Conrad, “ is the budget stresses from the baby boomers as they begin to retire en masse. ” Conrad quotes Federal Reserve Chairman Ben Bernanke, who recently testifi ed before the same committee: “ If early and meaningful action is not taken, the U.S. economy could be seriously weakened. The longer we wait, the more severe, the more draconian, the more diffi cult the objectives are going to be. I think the right time to start was about ten years ago. ”

Conrad continued, “ We need the will to put our fi scal house back in order . . . the sooner we act, the better. ”

“ We ’ re all involved in the Fiscal Wake - Up Tour, ” Bixby says, motioning to those who are testifying before the hearing.

“ Dave Walker is involved, as well. We ’ ve been going around the country holding town hall meetings . . . and talking to local media. We are fi nding the public seems to be willing to hear the tough choices that need to be made. What they want to make sure is that you ’ re serious about them, ” he added, pointing to the members of the Senate committee.

c02.indd 27

8/26/08 8:42:40 PM

28 The

Mission

When we talked to Senator Kent Conrad, the ranking member of the Senate Budget committee, after the hearing, he fl ipped the coin the other way:

Obviously, if the public doesn’t

“ Obviously, if the public doesn

’ t

understand, there’s going to be no

sense of urgency and no pressure

understand, there ’ s going to be no

on our colleagues [in Congress] or

sense of urgency and no pressure

in the White House to act.