I.O.U.S.A. (15 page)

Authors: Addison Wiggin,Kate Incontrera,Dorianne Perrucci

Tags: #Forecasting, #Finance, #Public Finance, #Economic forecasting - United States, #General, #United States, #Personal Finance, #Economic Conditions, #Economic forecasting, #Finance - United States - History, #Debt, #Debt - United States - History, #Business & Economics, #History

C h a p t e r 3

THE SAVINGS

DEFICIT

Too many Americans are following the bad example

of their federal government. They’re spending more

money then they make. They’re taking out home

equity loans. They’re charging up their credit cards.

They’re building up compound interest.

—David Walker

For two years in a row, in 2005 and 2006, American households spent more money than they took home.

That ’ s a negative savings rate. The last time the country had a negative savings rate was back in 1933 and 1934 — admittedly not good years for America or the world.

It wasn ’ t always this way for the United States. Previous generations didn ’ t believe that they could live on credit and borrow their way into prosperity.

“ Children of the Great Depression,

” Bill Bonner said,

“ didn ’ t have the delusion that you can get away with spending 43

c03.indd 43

8/26/08 8:43:42 PM

44 The

Mission

more money than you earn forever and ever. They thought that not spending too much was the way to go, they thought that savings were important. ”

But times have changed. In 2007, the savings rate was again historically low, but not in the negative range — hov-ering somewhere around 1 percent. Personal savings in the United States only amounts to 2 percent of the economy. In China, an economy gaining much of the world ’ s attention over the early part of the twenty - fi rst century, personal savings is equivalent to 40 percent of GDP.

In the United States, the concept of sacrifi ce and building for a better tomorrow has been pushed aside by our live - for -

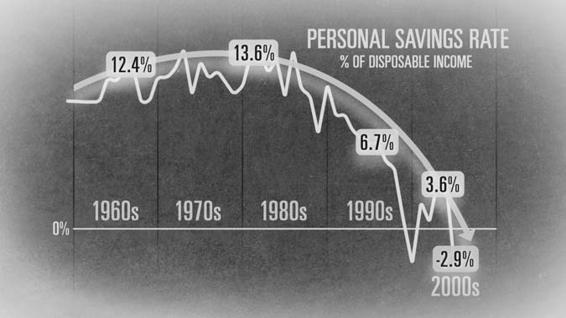

today, easy credit and consumption - oriented society. As many are beginning to see, low savings rates can be a problem. In healthy, productive economies, savings result in increased investment, additional research and development, a stronger overall economy, and an improvement in the average citizen ’ s standard of living. (See Figure 3.1 .)

SOURCE: Federal Reserve

Figure 3.1

Falling Savings Rate

Source:

Federal Reserve Bank.

c03.indd 44

8/26/08 8:43:51 PM

Chapter 3 The Savings Defi cit

45

What Americans Bought and Lost

Historically, low levels of savings mean that not only are people spending more than they ’ ve earned, but they are also increasingly borrowing money to fi nance purchases. What have Americans been buying? Since the beginning of the new century, a home - buying frenzy hauled the economy in the United States and much of the Western World. Following the collapse of the tech stock bubble on Wall Street, Americans began to look at their homes not as a place to live, or a long -

term investment, but as an ATM. Through refi nancing, they believed that they could take money out of their home at any time — and that the ATM would never run out of money. That ’ s all well and good as long as home prices are rising.

Many fi rst - time homeowners entered the market via

subprime

and other adjustable rate mortgages. These mortgages were set at a low teaser rate and the borrowers often put little or no money down.

In 2007, $375 billion in subprime loans reset to higher payments, and in 2008 another $340 billion will reset.