I.O.U.S.A. (12 page)

Authors: Addison Wiggin,Kate Incontrera,Dorianne Perrucci

Tags: #Forecasting, #Finance, #Public Finance, #Economic forecasting - United States, #General, #United States, #Personal Finance, #Economic Conditions, #Economic forecasting, #Finance - United States - History, #Debt, #Debt - United States - History, #Business & Economics, #History

on our colleagues [in Congress] or on

—KENT CONRAD

the White House to act. ”

The public needs to care and

may be moving in that direction.

“ There ’ s this perception, ” says Bob Bixby, “ that ‘ Oh, the public doesn ’ t care about it. These are just numbers, you know; it’s boring stuff. ’ But when we go to our town hall meetings . . .

people love it. What they ’ re frustrated

When we go to our town hall

with is that they can

’ t get straight

meetings . . . people love it. What

answers from politicians, or they ’ re

they’re frustrated with is that they

told things that just don ’ t make sense,

can’t get straight answers from

politicians, or they’re told things

like, ‘ We can cut taxes and add a pre-

that just don’t make sense.

scription drug benefi t to Medicare,

’

—BOB BIXBY

and you know instinctively people

think, ‘ I don ’ t think that really adds

up . . . but this guy is telling me that I can have it all so . . . okay, I ’ ll vote for him. ’ ”

There ’ s a joke going around Washington that goes something like this: The guy who promises to go to Washington and collect $10 in taxes, then send $10 back to the community, gets polite applause. But the guy who promises to collect $10 in taxes, then send back $11 — he gets elected.

Do we really believe the government can function this way?

The Silver Tsunami

If everyone

’ s pointing their fi nger in a different direction, who is really to blame? That ’ s what

I.O.U.S.A.

aims to fi nd out. Or, at the very least, we hope to get the parties involved c02.indd 28

8/26/08 8:42:40 PM

Chapter 2 The Budget Defi cit

29

to recognize that they, in turn, are each part of the problem and each must come to the table to seek a common solution.

Without it, the second - longest - standing republic in human history will fail. That is no small accomplishment.

In the past 40 years, the U.S. government has run 35 budget defi cits, and only 5 budget surpluses. (See Figure 2.2 .) Lucky for them, at the same time, Uncle Sam has been running large annual surpluses in our Social Security program.

Those surpluses are spent every year to help pay other bills the federal government has run up.

Here ’ s where the trouble lies.

If you discount the Social Security surpluses, the government ’ s real track record on spending money it doesn ’ t have looks even worse. By 2017, less than 10 years from now, the Social Security program will start paying out more than it garners in revenue. As the baby boomers retire in larger and larger numbers, the balance sheet of the Social Security trust fund deteriorates.

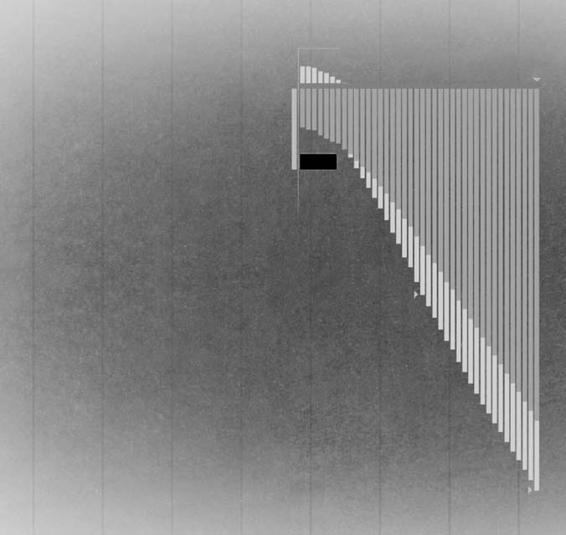

Beyond 2017, Social Security will no longer help the government pay its bills. (See Figure 2.3 .) Defi cits in the Medicare

Figure 2.2

The U.S. Budget over 40 Years: 35 Defi cits, 5 Surpluses c02.indd 29

8/26/08 8:42:40 PM

30 The

Mission

PROJECTIONS

SOCIAL SECURITY + MEDICARE

ANNUAL DEFICIT

'08

'09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23 '24 '25 '26 '27 '28 '29 '30 '31 '32 '33 '34 '35 '36 '37 '38 '39 '40 '41 '42 '43 '44 '45 '46 '47 '48

2008 BUDGET DEFICIT

$410 BILLION

– $1 TRILLION

SOURCE: Social Security and Medicare Trustees Report, 2008

– $2 TRILLION

Figure 2.3

Defi cit Projections, Including Social Security past 2017

Source:

Social Security and Medicare Trustees Report 2008.

program and other federal spending will only serve to make the situation worse.

One second past the stroke of midnight on January 1, 1946, a star was born. The nation

’ s fi rst baby boomer.

Kathleen Casey - Kirschling, has had this distinction throughout her life — she even has a boat aptly named

First Boomer.

On October 15, 2007, Casey - Kirschling, applied for Social Security benefi ts. Over the next 20 years, some 80 million other Americans will follow suit — and the U.S. government is ill equipped to provide for them.

c02.indd 30

8/26/08 8:42:41 PM

Chapter 2 The Budget Defi cit

31

Called the

silver tsunami,

the Social Security crisis is projected to only get worse as the years go on. On October 15, 2007, Reuters reported, “ The latest report by the program ’ s trustees said by 2017, Social Security will begin to pay more in benefi ts than it receives in taxes. By 2041, the trust fund is projected to be exhausted. ”

The Federal balance sheet is already unsustainable. And the baby boomers have only begun to retire this year. “ The baby boomers are not a projection, ” says Senator Conrad.

“ They were born, they ’ re out there, they ’ re going to be eligible for social security and Medicare . . . and yet we can ’ t pay our bills now. ”

Judd Gregg, the Republican leader in the Senate Budget Committee, puts the looming problems of these unfunded liabilities this way: “ The only issue more severe than this is the idea that an Islamic fundamentalist would get his or her hands on a nuclear weapon and use it against us. Beyond that there ’ s nothing more severe than this. ”

Gregg goes on to state that the

The retirement of the baby boom-retirement of the baby boomers rep-

ers represents the potential fi scal

resents “ the potential fi scal meltdown

meltdown of this nation . . . and

of this nation . . . and absolutely guar-absolutely guarantees, if it’s not

addressed, that our children will

antees, if it ’ s not addressed, that our

have less of a quality of life then

children will have less of a quality of

we’ve had . . . that they will have a

life then we ’ ve had . . . that they will

government they can’t afford . . .

have a government they can ’ t afford

and that we will be demanding so

. . . and that we will be demanding so

much of them in taxes that they

much of them in taxes that they will

will not have the money to send

their kids to college or buy a home

not have the money to send their kids

or just live a good quality of life.

to college or buy a home or just live a

—JUDD GREGG

good quality of life. ”

These grave warnings from leaders in both political parties have largely fallen on deaf ears, but we believe Americans can no longer hide from them. Simple economics dictate that you may be able to spend more than you take in for a long time, but you cannot do it forever.

c02.indd 31

8/26/08 8:42:42 PM

32 The

Mission

What Is a Budget Defi cit?

In the 1970s, the members of Congress believed they needed a budget offi ce that would help them look at the federal budget and make decisions about it the way the Offi ce of Management and Budget helps the president make his decisions. So in 1974 they passed a law called the Budget Reform Act of 1974 that set up the Congressional Budget Offi ce (CBO).

The data that the CBO generates, then and now, are the most commonly used numbers in and around Washington.

Ostensibly, this Offi ce was created to give the Congress a solid, nonpartisan, professional set of numbers. While there is always some uncertainty regarding the numbers, the CBO

does not have any political axe to grind. They work for both the House and the Senate, and they work for the Republicans and the Democrats, and are regarded among those bodies and the press as a reliable source of statistics for measuring the health of the federal government and the economy.

“ I was very lucky, ” Alice Rivlin told us when we met her for the interview in her offi ce in Washington. Ms. Rivlin was the fi rst director of the Congressional Budget Offi ce in 1975.

“ I was there eight and a half years. I loved it. It was a fascinating thing to do. I loved it in part because I like working for the Congress. It is a very interesting group of people, and the issues are interesting. And I think I also liked it because it was entrepreneurial. I got to set up this whole new organization.

That is a little bit like starting a new company. ”

Ms. Rivlin has been fascinated with the “ dismal science ”

ever since she took a summer school class in economics in college, and hasn ’ t looked back ever since. Passionate about how taxes, budgets, welfare, and public policies affect people and the economy, she is currently an economist at the Brookings Institution, an independent research and policy institute in Washington, which is also involved in the Fiscal Wake - Up Tour.

“ Defi cits matter, ” says Rivlin. “ A defi cit occurs when the federal government is spending more than it ’ s taking in in c02.indd 32

8/26/08 8:42:43 PM

Chapter 2 The Budget Defi cit

33

revenues, and that means it has to borrow money. We are not

Defi cit:

A defi cit

paying for the government ’ s services we are asking our govern-

occurs when the

ment to provide. ”

federal government

is spending more

The government, in turn, borrows the money and passes

than it’s taking in in

the IOU or bill on to the next generation.

revenues, and that

“ Right now, ” offers Ms. Rivlin, “ if you look at the fed-

means it has to

eral budget, [the government] is running a defi cit and it will

borrow money.

probably run a defi cit for the next several years. Those defi cits are not off the charts. We have been there before. But what is really worrisome is the longer - run future. ”

Under current rules, Federal spending for three programs —

Medicare, Medicaid, and Social Security — will rise very rapidly over the next few years.

Rivlin continues: “ Increases in longevity and rising medical care spending are symptoms of being a rich country. However, we have got to do something about it. Unless we are willing to raise taxes and keep on raising them, or close down the rest of the federal government, we ’ ve got a very big problem staring us in the face. We ’ ve got to decide, are we getting our money ’ s worth for all of this spending? And who ’ s going to pay for it? ”

Bearing these high debt levels and forcing future generations to pay for current programs is at odds with the ideas written and espoused by the founders of the country. “ Jefferson went on record saying that it was immoral for one generation to load up the next generation with debt, ” says best - selling author and friend Bill Bonner. “ In private life we don ’ t do that. A person goes to his grave and his debts go with him, more or less. ” (We met with Bill several times during the fi lming of

I.O.U.S.A.

His ideas were instrumental in the development of the fi lm.)

“ In public we have this system whereby one generation can spend money before it ’ s been earned, ” Bill continues. “ Then somebody ’ s got to pay that money in the future, and that somebody is the next generation. To me that is an immoral situation, and it ’ s not just immoral, it ’ s fundamentally wrong

— and mean

— for one generation to spend the

next generation ’ s money. ”

c02.indd 33

8/26/08 8:42:43 PM

34 The

Mission

The Concerned Youth of America

The idea that future generations should have to foot the bill for decisions they were too young

— or not even alive

— to

make doesn ’ t sit well with a minority of aware and active young people today.

One group we were introduced to by Harry Zeeve calls themselves

“ the Concerned Youth of America

” (CYA).

Rightfully so, the members of the CYA see the defi cit spending engaged in by the U.S. government as a modern form of taxation without representation.