The Rise and Fall of the Great Powers (18 page)

Read The Rise and Fall of the Great Powers Online

Authors: Paul Kennedy

Tags: #General, #History, #World, #Political Science

Yet however natural all this may appear to later eyes, it is important to stress that the success of such a system depended on two critical factors: reasonably efficient machinery for raising loans, and the maintenance of a government’s “credit” in the financial markets. In both respects, the United Provinces led the way—not surprisingly, since the merchants there were part of the government and desired to see the affairs of state managed according to the same principles of financial rectitude as applied in, say, a joint-stock company. It was therefore appropriate that the States General of the Netherlands, which efficiently and regularly raised the taxes to cover governmental expenditures, was able to set interest rates very low, thus keeping down debt repayments. This system, superbly reinforced by the many financial activities of the city of Amsterdam, soon gave the United Provinces an international reputation for clearing bills, exchanging currency, and providing credit, which naturally created a structure—and an atmosphere—within which long-term funded state debt could be regarded as perfectly normal. So successfully did Amsterdam become a center of Dutch “surplus capital” that it soon was able to invest in the stock of foreign companies and, most important of all, to subscribe to a whole variety of loans floated by foreign governments, especially in wartime.

7

The impact of these activities upon the economy of the United Provinces need not be examined here, although it is clear that Amsterdam would not have become the financial capital of the continent had it not been supported by a flourishing commercial and productive base in the first place. Furthermore, the very long-term consequence was probably disadvantageous, since the steady returns from government loans turned the United Provinces more and more away from a manufacturing economy and into a

rentier

economy, whose bankers were somewhat disinclined to risk capital in large-scale industrial ventures by the late eighteenth century; while the ease with which loans could be raised eventually saddled the Dutch government with an enormous burden of debt, paid for by excise duties which increased both wages and prices to uncompetitive levels.

8

What is more important for the purposes of our argument is that in subscribing to

foreign

government loans, the Dutch were much less concerned about the religion or ideology of their clients than about their financial stability and reliability. Accordingly, the terms set for loans to European powers like Russia, Spain, Austria, Poland, and Sweden can be seen as a measure of their respective economic potential, the collateral they offered to the bankers, their record in repaying interest and premiums, and ultimately their prospects of emerging successfully from a Great Power war. Thus, the plummeting of Polish governmental stock in the late eighteenth century and, conversely, the remarkable—and frequently overlooked—strength of Austria’s credit

for decade after decade mirrored the relative durability of those states.

9

But the best example of this critical relationship between financial strength and power politics concerns the two greatest rivals of this period, Britain and France. Since the result of their conflict affected the entire European balance, it is worth examining their experiences at some length. The older notion that eighteenth-century Great Britain exhibited adamantine and inexorably growing commercial and industrial strength, unshakable fiscal credit, and a flexible, upwardly mobile social structure—as compared with an

ancien régime

France founded upon the precarious sands of military hubris, economic backwardness, and a rigid class system—seems no longer tenable. In some ways, the French taxation system was less regressive than the British. In some ways, too, France’s economy in the eighteenth century was showing signs of movement toward “takeoff” into an industrial revolution, even though it had only limited stocks of such a critical item as coal. Its armaments production was considerable, and it possessed many skilled artisans and some impressive entrepreneurs.

10

With its far larger population and more extensive agriculture, France was much wealthier than its island neighbor; the revenues of its government and the size of its army dwarfed those of any western European rival; and its

dirigiste

regime, as compared with the party-based politics of Westminster, seemed to give it a greater coherence and predictability. In consequence, eighteenth-century Britons were much more aware of their own country’s relative weaknesses than its strengths when they gazed across the Channel.

For all this, the English system possessed key advantages in the financial realm which enhanced the country’s power in wartime and buttressed its political stability and economic growth in peacetime. While it is true that its

general

taxation system was more regressive than that of France—that is, it relied far more upon indirect than direct taxes—particular features seem to have made it much less resented by the public. For example, there was in Britain nothing like the vast array of French tax farmers, collectors, and other middlemen; many of the British duties were “invisible” (the excise duty on a few basic products), or appeared to hurt the foreigner (customs); there were no

internal

tolls, which so irritated French merchants and were a disincentive to domestic commerce; the British land tax—the chief direct tax for so much of the eighteenth century—allowed for no privileged exceptions and was also “invisible” to the greater part of society; and these various taxes were discussed and then authorized by an elective assembly, which for all its defects appeared more representative than the

ancien régime

in France. When one adds to this the important point that per capita income was already somewhat higher in Britain than in France even by 1700, it is not altogether surprising that the population

of the island state was willing and able to pay proportionately larger taxes. Finally, it is possible to argue—although more difficult to prove statistically—that the comparatively light burden of direct taxation in Britain not only increased the propensity to save among the better-off in society (and thus allowed the accumulation of investment capital during years of peace), but also produced a vast reserve of taxable wealth in

wartime

, when higher land taxes and, in 1799, direct income tax were introduced to meet the national emergency. Thus, by the period of the Napoleonic War, despite a population less than half that of France, Britain was for the first time ever raising more revenue from taxes each year in

absolute

terms than its larger neighbor.

11

Yet however remarkable that achievement, it is eclipsed in importance by the even more significant difference between the British and French systems of public credit. For the fact was that during most of the eighteenth-century conflicts, almost three-quarters of the

extra

finance raised to support the additional wartime expenditures came from loans. Here, more than anywhere else, the British advantages were decisive. The first was the evolution of an institutional framework which permitted the raising of long-term loans in an efficient fashion and simultaneously arranged for the regular repayment of the interest on (and principal of) the debts accrued. The creation of the Bank of England in 1694 (at first as a wartime expedient) and the slightly later regularization of the national debt on the one hand and the flourishing of the stock exchange and growth of the “country banks” on the other boosted the supply of money available to both governments and businessmen. This growth of paper money in various forms

without

severe inflation or the loss of credit brought many advantages in an age starved of coin. Yet the “financial revolution” itself would scarcely have succeeded had not the obligations of the state been guaranteed by successive Parliaments with their powers to raise additional taxes; had not the ministries—from Walpole to the younger Pitt—worked hard to convince their bankers in particular and the public in general that they, too, were actuated by the principles of financial rectitude and “economical” government; and had not the steady and in some trades remarkable expansion of commerce and industry provided concomitant increases in revenue from customs and excise. Even the onset of war did not check such increases, provided the Royal Navy protected the nation’s overseas trade while throttling that of its foes. It was upon these solid foundations that Britain’s “credit” rested, despite early uncertainties, considerable political opposition, and a financial near-disaster like the collapse of the famous South Seas Bubble of 1720. “Despite all defects in the handling of English public finance,” its historian has noted, “for the rest of the century it remained more honest, as well as more efficient, than that of any other in Europe.”

12

The result of all this was not only that interest rates steadily dropped,

*

but also that British government stock was increasingly attractive to foreign, and particularly Dutch, investors. Regular dealings in these securities on the Amsterdam market thus became an important part of the nexus of Anglo-Dutch commercial and financial relationships, with important effects upon the economies of both countries.

13

In

power-political

terms, its value lay in the way in which the resources of the United Provinces repeatedly came to the aid of the British war effort, even when the Dutch alliance in the struggle against France had been replaced by an uneasy neutrality. Only at the time of the American Revolutionary War—significantly, the one conflict in which British military, naval, diplomatic, and trading weaknesses were most evident, and therefore its credit-worthiness was the lowest—did the flow of Dutch funds tend to dry up, despite the higher interest rates which London was prepared to offer. By 1780, however, when the Dutch entered the war on France’s side, the British government found that the strength of its own economy and the availability of domestic capital were such that its loans could be almost completely taken up by domestic investors.

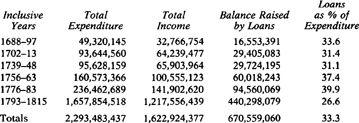

The sheer dimensions—and ultimate success—of Britain’s capacity to raise war loans can be summarized as in

Table 2

.

Table 2. British Wartime Expenditure and Revenue, 1688–1815

(pounds)

And the strategical consequence of these figures was that the country was thereby enabled “to spend on war out of all proportion to its tax revenue, and thus to throw into the struggle with France and its allies the decisive margin of ships and men without which the resources previously committed might have been committed in vain.”

14

Although many British commentators throughout the eighteenth century trembled at the sheer size of the national debt and its possible consequences, the fact remained that (in Bishop Berkeley’s words) credit

was “the principal advantage that England hath over France.” Finally, the great growth in state expenditures and the enormous, sustained demand which Admiralty contracts in particular created for iron, wood, cloth, and other wares produced a “feedback loop” which assisted British industrial production and stimulated the series of technological breakthroughs that gave the country yet another advantage over the French.

15

Why the French failed to match these British habits is now easy to see.

16

There was, to begin with, no proper system of

public

finance. From the Middle Ages onward, the French monarchy’s financial operations had been “managed” by a cluster of bodies—municipal governments, the clergy, provincial estates, and, increasingly, tax farmers—which collected the revenues and supervised the monopolies of the crown in return for a portion of the proceeds, and which simultaneously advanced monies to the French government—at handsome rates of interest—on the expected income from these operations. The venality of this system applied not only to the farmers general who gathered in the tobacco and salt dues; it was also true of that hierarchy of parish collectors, district receivers, and regional receivers general responsible for direct taxes like the

taille

. Each of them took his “cut” before passing the monies on to a higher level; each of them also received 5 percent interest on the price he had paid for office in the first place; and many of the more senior officials were charged with paying out sums directly to government contractors or as wages, without first handing their takings in to the royal treasury. These men, too, loaned funds—at interest—to the crown.

Such a lax and haphazard organization was inherently corrupt, and much of the taxpayers’ monies ended in private hands. On occasions, especially after wars, investigations would be launched against financiers, many of whom were induced to pay “compensations” or accept lower interest rates; but such actions were mere gestures. “The real culprit,” one historian has argued, “was the system itself.”

17

The second consequence of this inefficiency was that at least until Necker’s reforms of the 1770s, there existed no overall sense of national accounting; annual tallies of revenue and expenditure, and the problem of deficits, were rarely thought to be of significance. Provided the monarchy could raise funds for the immediate needs of the military and the court, the steady escalation of the national debt was of little import.